Invesco has decided to close its £364m Global Targeted Returns strategy following a long run of underwhelming performance.

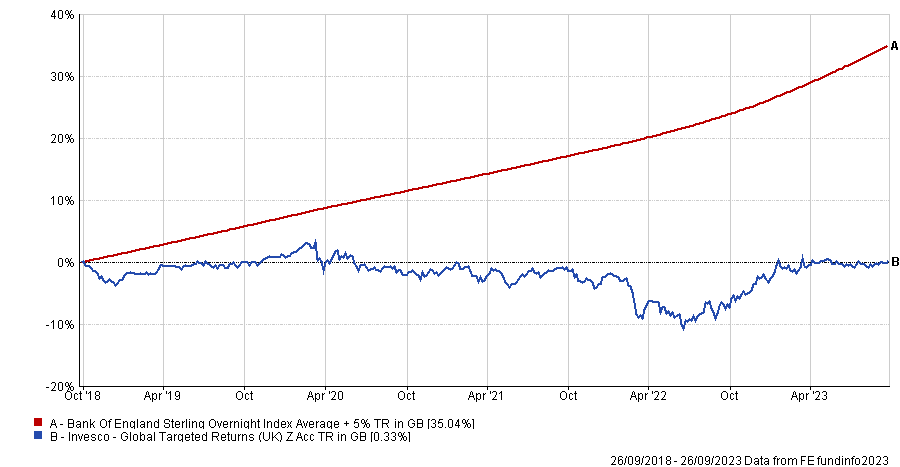

Invesco Global Targeted Returns has struggled mightily over the past five years, up just 0.33% over this time, failing to beat the benchmark index by some 35 percentage points, as the below chart shows.

Its goal to achieve positive returns over rolling three-year periods has also been out of reach in recent times. Looking at the three-year returns of the fund at the end of each month over the past three years, it has made a positive return just twice out of the 36 data points.

It was managed at inception by David Millar, Dave Jubb and Richard Batty – three hires from the abrdn Global Absolute Return Strategy (GARS) team. Batty remains on the team but both Millar and Jubb have since stepped back from management duties.

The former retired while the latter moved to a research role, with Gwilym Satchell, Sebastian MacKay and Georgina Taylor joining as co-managers in 2018, 2020 and 2021 respectively.

It was launched a decade ago as a rival product to the once-mighty GARS, but has suffered a similar fate to its peer, which was shuttered earlier this year. It is a marked fall from grace for the behemoth strategies, which were once hugely popular with investors.

Invesco blamed the current “lack of demand” for absolute return strategies, which have been much-maligned in recent years, as the reason for its closure.

Stephanie Butcher, senior managing director and co-head of investments at Invesco, said: “Demand has shifted and innovation in other areas is constantly evolving, so we have taken the difficult decision to close the global targeted return strategy.”

Total return of fund vs benchmark index over 5yrs

Source: FE Analytics

Invesco will move forward with its Summit ranges and model portfolio services along with “tailored portfolios for institutional and retail clients,” Butcher said.

“We will continue to look at product innovation and to leverage off the broad collaborative expertise we have across the global investments platform. We are committed to our existing suite of multi-asset products and remain focused on meeting strong demand in the wide range of capabilities we offer across the firm.”