A market-cap weighted tracker is a common way for investors to gain exposure to the US market. Over the past 10 years, this approach has been very rewarding as large companies, headlined by the tech giants, have dominated the S&P 500.

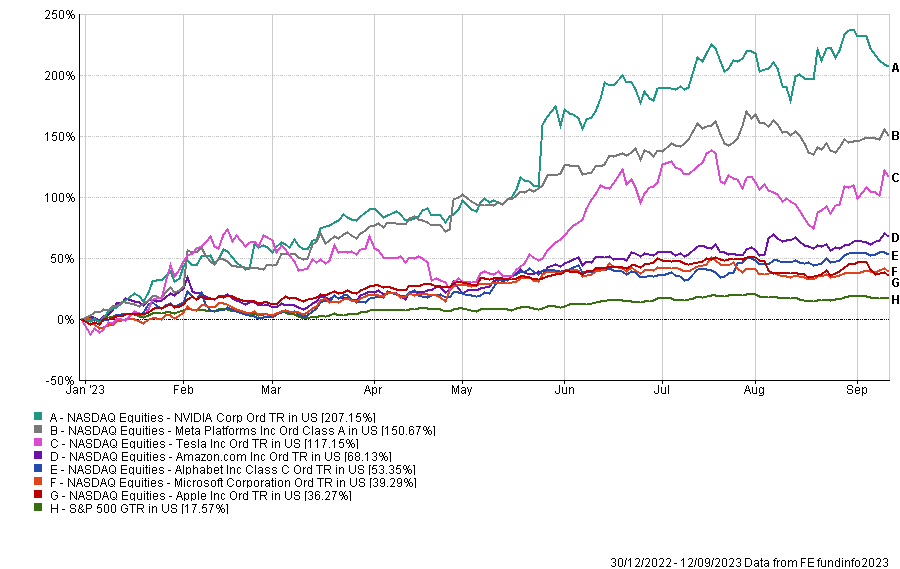

This approach has benefited investors this year, with the market led the ‘magnificent seven’ (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta), which have bounced on enthusiasm around artificial intelligence (AI).

But this seemingly ever-narrowing group of market leaders means high concentration is causing concerns among experts, as the magnificent seven are currently commanding nearly 30% of the S&P 500 index.

Priscilla Cheung, investment specialist at Brooks Macdonald, said: “This concentration underscores the potential vulnerability of investors to significant downside risks in the event of a shift in market sentiment or a waning of momentum.”

Performance of stocks and index YTD

Source: FE Analytics

This is also the view of Chris Justham, head of intermediary at 7IM, who said current valuations of the magnificent seven do not reflect their earnings.

For instance, Nvidia is trading on a three-digit price-to-earnings (P/E) ratio, which is a measure showing what the market is ready to pay for a stock based on its earnings (past or prospective) and to assess whether a stock is overvalued or undervalued.

Justham said: “Passive, market-cap weighted trackers are extremely popular and have exacerbated this rise. This has meant that the share prices of a few companies have been disassociated from their underlying fundamentals.

“One of the questions we're asking ourselves at the moment is whether we are in an AI stock bubble and it's increasingly looking like we are. By virtue of that, we would prefer not to be exposed to those businesses that have been caught up in that euphoria.”

While he does not think they are bad businesses, Justham said 7IM wants to maintain a balance and ensure it is not taking a notable overweight to a sector deemed expensive.

Therefore, the firm has cashed in the gains made through S&P 500 market-cap weighted trackers over the past few years and reallocated to “future winners”.

Justham said: “We prefer a simple strategy – equal-weighting the S&P 500. The other 493 companies in the index are also good businesses. These mid-cap companies are cheap, largely profitable and, unlike the seven, have room to grow.”

This is something Brooks Macdonald is also doing, with the wealth manager now preferring equal-weighted index trackers as well as actively managed funds.

Cheung said: “Our goal is to balance mega-caps with the broader market, to ensure that our portfolios remain resilient in changing market conditions.”

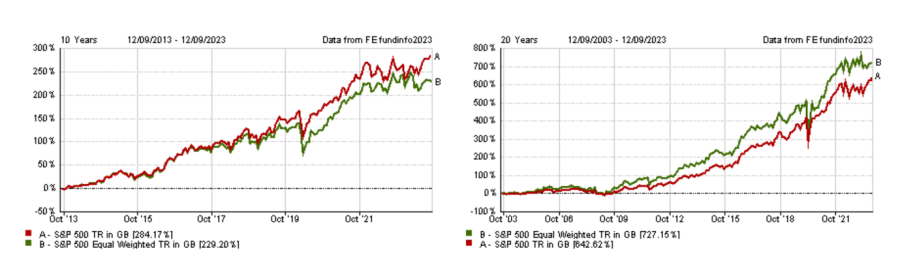

Performance of indices over 10 and 20yrs

Source: FE Analytics

Historically, the equal-weighted index has outperformed the size-weighted one, although it hasn’t been the case over the past decade. Historical trends suggest markets tend to return to their average performance over time, however.

As a result, Cheung called “rational investors” to anticipate the eventual closing of this gap, but added that disparities can persist longer than expected.

Justham concluded: “The best periods of performance come after a peak in the cap-weighted index concentration, both through avoiding the pain on the way down and then rallying on the way up.

“In 2000, the equal-weight index avoided the bubbly tech stocks. In 2008, it avoided the banks and real estate businesses. In 2023, we think mid-cap is starting to make a lot of sense again.”

Similarly, Alex Tedder, manager of the Schroder Global Equity fund, is seeing more opportunities in the mid- and small-cap space in the US, as he finds the top of the S&P 500 too expensive.

He said: “The US has done far too well and it is an expensive markets. But if you strip out the top decile of high growth companies, the rest of the US market is actually trading at quite a big discount to historical averages.”