There are several absolute return funds that have endured years of losses over the past decade despite such strategies being created a safety nets for portfolios, Trustnet analysis shows.

The IA Targeted Absolute Return sector is under renewed attention after it emerged that the abrdn Global Absolute Return Strategies fund (often known as ‘GARS’) would be merged into another fund.

GARS used to be one of the most popular funds in the industry and its assets peaked at £26.8bn when it was almost seen as the default option for a portfolio’s absolute return allocation. But it has performed poorly for a number of years and has haemorrhaged money. Today, it is just £857m in size.

GARS vs sector, equities and bonds over 3yrs

Source: FE Analytics

However, absolute return funds as a group have disappointed investors in recent years. While they are seen as aiming to generate positive returns in any market condition, in reality many have failed to keep their heads above water in recent choppy markets and have been hit with losses.

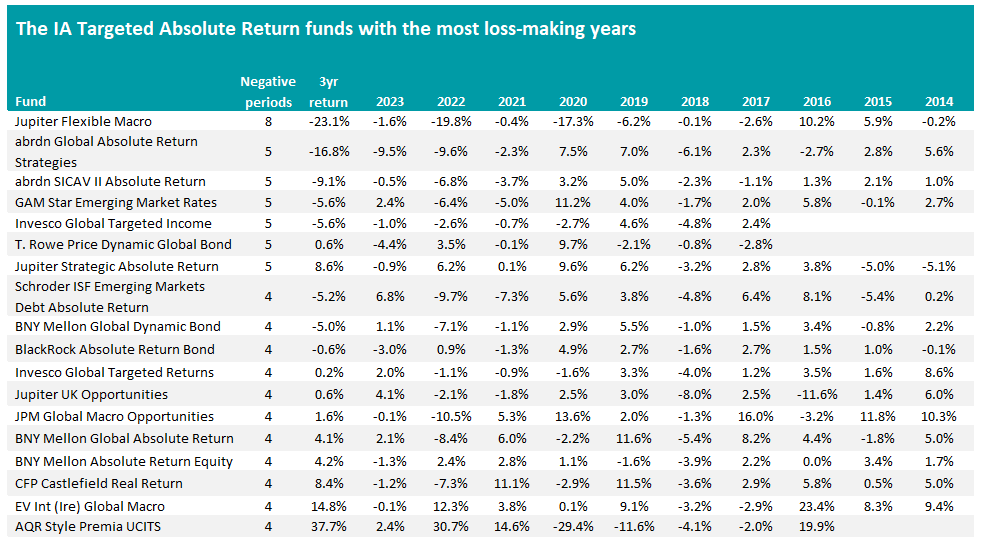

In this research, we ran the numbers for the IA Targeted Absolute Return sector over the past 10 full calendar years and 2023 to date to see how successful funds have been in making positive returns. Admittedly, this is a harder test than the funds set themselves, as many have the target of making positive returns over rolling 36-month periods rather than over 12 months.

How has abrdn Global Absolute Return Strategies come out in this study? It should come as little surprise to find out that it was one of the worst funds.

Of the 11 periods we examined, the former star fund lost money in five of them. Its recent poor run stands out – GARS made negative returns in 2021 (down 2.3%) and 2022 (down 9.6%) as well as dropping a further 9.5% over 2023 to date.

With a loss of 16.8%, the fund is one of the worst performers in the IA Targeted Absolute Return sector over the past three years – a challenging time in markets when investors were hoping their more defensive holdings would protect them.

However, GARS wasn’t the fund that came out worst in this research as Jupiter Flexible Macro has a weaker recent track record.

Jupiter Flexible Macro vs sector, equities and bonds over 3rs

Source: FE Analytics

The £30m fund – which used to be called Jupiter Absolute Return – made a loss in eight of the 11 periods we examined in this research. This includes a fall of close to 20% in 2022.

Over three years, Jupiter Flexible Macro has fallen 23.1%, which is the worst result of the IA Targeted Absolute Return sector.

While the recent past performance of this fund is disappointing, its future is also uncertain as it has been proposed that it will merged into the Jupiter Global Macro Bond fund. This will be subject to a vote by unitholders at an extraordinary general meeting on 21 August.

Jupiter Flexible Macro was managed by James Clunie under its original name and was taken over by Talib Sheikh after Clunie's departure. After Sheikh then left Jupiter, it was handed to Mark Nash and team - who run Jupiter Global Macro Bond - towards the end of 2022 so the current managers have little to do with its track record.

Jupiter Global Macro Bond only recently adopted an absolute return objective and joined the sector at the end of July. Prior to this move, it was in the IA Global Mixed Bond sector and had outperformed its average peer over one, three, five and 10 years.

Source: FE Analytics

Another five funds join abrdn Global Absolute Return Strategies in making a loss in five of the 11 periods, but some have made positive returns more recently. Jupiter Strategic Absolute Return Bond, for example, is up 8.6% over three years.

Likewise, 11 funds have lost money in four of the periods including well-known names such as BNY Mellon Global Dynamic Bond and BlackRock Absolute Return Bond, both of which are down over three years.

But others have made strong returns over this more recent time, such as AQR Style Premia UCITS – which has gained 37.7%.