Sometimes it can be hard to ignore the huge upside potential of stocks and other speculative assets, whether it be the GameStop saga or the volatility of cryptocurrency.

More recently, the rise of artificial intelligence (AI) has prompted many to return to the high-growth assets that have won over the past decade, despite the headwind of rising interest rates.

As Artemis Global Income co-manager Jacob de Tusch-Lec wrote this week on Trustnet, phone maker Apple is up nearly 50% this year while software firm Microsoft has made 50% on the back of this latest burst of investor interest.

But it is worth remembering that betting on booming assets is not the only way to make money. And although they offer enticing returns, things can sour quickly.

Indeed, between April Fool’s Day and New Year’s Eve last year – when tech was massively out of favour – Apple, Microsoft, Tesla, Amazon and Nvidia lost 41.6% on average (against the S&P, which lost just 15.5%).

Despite their recent rise, Amazon remains 17.7% lower than it was at the start of April 2022, while Tesla is down 28.8%. Apple and Microsoft are up, but only 9.7% and 11.7% respectively – far below the returns investors have come to expect from the tech giants. Only Nvidia breaks the mould, up 70% during this period as the chipmaker has more direct links with AI.

Ian Jensen-Humphreys, portfolio manager at Quilter Investors, reminded investors last week that sometimes it is more important to avoid the biggest losers than to pick the biggest winners.

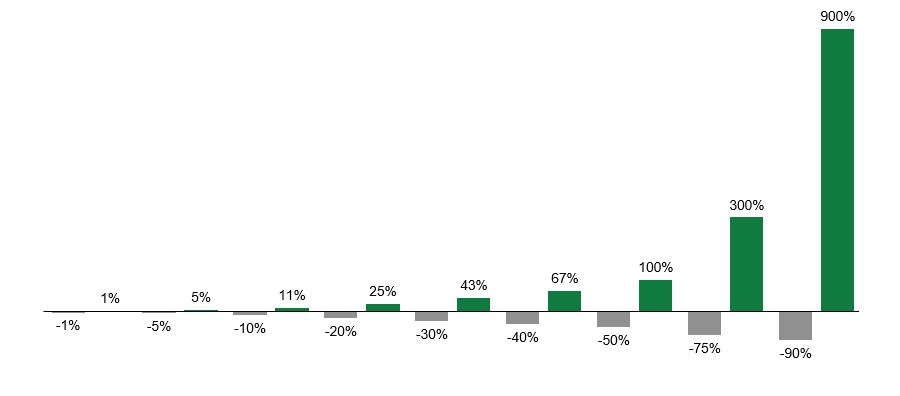

The chart below shows how much an asset will have to make to return to parity after a fall. If a stock halves, it will need to double to get back to its original price, but bigger falls are much harder to claw back. Although this may seem basic, it is sometimes easy to forget.

Source: Quilter Investors

Jensen-Humphreys said: “Investors can sometimes get fixated on chasing after growth, often at the expense of assets that can give a good element of defence should markets turn.

“As we have seen in the past few years, markets can turn quickly and gains can be wiped out sharply by harsh losses. For a long-term investor, therefore, it makes complete sense to also think about protecting your portfolio in downturns, even if this means potentially sacrificing some gains in rising markets.”

I myself have never bought into cryptocurrencies. I also sat on the sidelines during the GameStop sage and have not delved into US tech names over the past six months.

Admittedly, it is a boring attitude, but I prefer to take my bets on the horses, or on the poker table. That is money I am willing (although never happy) to lose.

My ISA? That’s for long-term savings. So slightly more defensive holdings make up my own portfolio. For those even more cautious than myself, there is always cash.