Oil companies flourished last year as soaring prices put them in the minority of stocks to end 2022 on a positive returns, but their success has slowed considerably in 2023.

Fuel prices rose rapidly after many western countries cut off imports from one of their largest oil providers, Russia, following its invasion of Ukraine.

However, so far this year, fuel prices have balanced out from the 2022 highs and this has been the largest downward contribution to inflation in the UK and around the world.

Investors who jumped on the oil bandwagon may be wondering now whether the rally has come to an end or if oil stocks are set to continue winning.

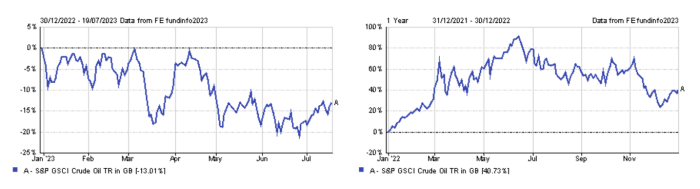

Crude oil returns in 2023 and 2022

Source: FE Analytics

Tyndall Real Income manager Simon Murphy took the opportunity to trim down his exposure to oil companies this year. BP made a hefty 49.7% return for Murphy last year, so he decided to bank the gains and cut down his position in the company.

“I had more in BP when those types of companies were very unloved and undervalued,” Murphy said. “The oil price was very depressed but you roll forward 18 months to today and those prices recovered strongly. Equally, those shares have performed very well.”

He is still positive on the future of oil companies but said most of the growth has already happened and future returns are unlikely to match the burst of last year.

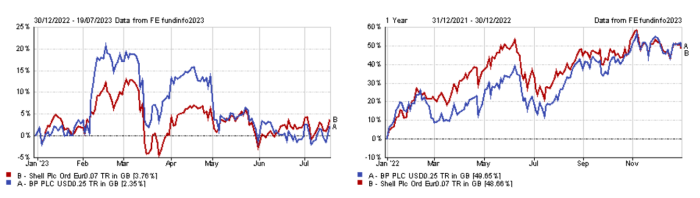

You can already see signs of slowing performance in the UK’s two largest players, Shell and BP, with their share pricing slowing to modest gains of 3.8% and 2.4% respectively so far this year.

Share price of BP and Shell in 2023 and 2022

Source: FE Analytics

Murphy added: “The likes of BP and Shell are they still moderately cheap if you think oil is likely to stay around this price.

“There’s still opportunity for them to generate a decent source of cash that they can pay back to shareholders in dividends, but they're not as extremely cheap as they were 18 months ago.”

Shares in BP and Shell may have swelled massively in 2022, but Murphy pointed out that many other stocks fell equally as far in the opposite direction – those are the companies he finds more attractive at their current depressed valuations.

“I don't have anything negative against [oil companies] – I don't even think they're expensive – I just think there's much more opportunity elsewhere,” Murphy explained.

Meanwhile, others such as Capital Gearing’s Peter Spiller have taken the opportunity to buy into oil exposure this year.

Less than a third (27%) of the holdings in his £1.1bn trust are in equities, with Spiller preferring fixed income assets to meet the goal of preserving investor’s capital. Nevertheless, he was persuaded by the investment case for oil as a vehicle for defensive growth.

“The valuations are not excessive – I'd say they're pretty cheap actually,” Spiller said. “We expect a very decent return from them over time, all in the context of our very low equity exposure.”

Although governments are aiming to ease the use of oil and transition to renewable energy, Spiller noted that demand is likely to continue rising.

With a shrinking number of oil suppliers and a rise in demand, he expects investors will be rewarded as oil prices rise.

“The government is doing its best to prevent development, so the overall production will not be enough,” Spiller added. “Therefore the price of energy and commodities will be significantly higher in five years’ time, so that’s a buy and hold situation.”

Oil companies in the UK will not be the only beneficiaries of rising prices – dwindling supply and rising necessity will impact global markets, according to Tom Nelson, head of thematic equities at Ninety One.

He noted how OPEC – a council of the world’s leading oil-producing countries – has announced several cuts to oil production over the past year.

This reduced output at a tine when there could be a wave of demand from China as it reopens, which should give investors confidence for further strength in the oil price moving forward.

If China’s desire for oil is strong enough, Nelson forecast that prices “could move quite rapidly up from the 70s to the upper 80s and 90s”.

He added: “As ever in the oil market, you’ve got uncertainties on both the supply and demand sides and sentiment is pretty shaky, but if we’ve learnt anything over the years it’s that relatively small moves can have outsized impacts, so we will be watching and waiting very carefully.”

This point was also stressed by BlackRock Energy and Resources Income Trust co-manager Mark Hume, who said lower production from big oil producers could be a good signal for the sector.

“OPEC’s actions to reduce announced production demonstrate a willingness, in our view, to be more reactive to manage oil prices, but also suggests uncertainty around demand near term,” he said.

“We believe this skews the opportunity for energy equities more positively by protecting the downside.”

However, Nelson warned that OPEC’s actions did reveal concerns markets have about the future appetite of oil. There are already large stockpiles that may be enough to satisfy China’s needs if its consumption is less than expected.

Similarly, tensions between some of OPEC’s members have created a “challenging and quite fractious existence” that can be difficult to predict.

Nelson said: “There is a latent volume of oil sitting in spare capacity that the market can readily absorb when there’s a significant upswing in Chinese demand in the second half of the year – in the event that does come through.

“That’s why there’s this feeling of slight unease and uncertainty. We could see an outcome where Saudi Arabia loses patience with other OPEC members and decides to step back from guardianship of the market, in which case oil could fall quite far, quite fast, although I think that would be short lived.”