There are only six funds in the IA Flexible Investment sector that have scored the strongest information ratios among their peers over the past decade, research by Trustnet shows.

This series has searched for funds that have consistently had the highest information ratios – a metric used to determine when returns are down to skill rather than luck. This risk-adjusted measure is designed to reflect the ability of a fund manager in generating excess returns relative to a benchmark.

It is calculated by taking the portfolio's active return (the difference between the portfolio return and the benchmark return) and dividing it by the tracking error, which is the standard deviation of the active return. A higher ratio indicates a better risk-adjusted performance.

Using the average fund as the benchmark, Trustnet ran the information ratio of each IA Flexible Investment fund over the past 10 full calendar years as well as 2023 to the end of June. We sorted them by quartile to see which have spent the most time at the top of the sector for this measure.

There were six funds that were in the top quartile in more than half of the 11 periods reviewed in this research but only one has avoided a stint in the bottom quartile: BNY Mellon Multi-Asset Growth.

Performance of BNY Mellon Multi-Asset Growth since start of 2013

Source: FE Analytics. Total return between 1 Jan 2013 and 30 Jun 2023

It has made a 182% total return over the full period we examined, which is almost 100 percentage points higher than the average IA Flexible Investment fund and the fourth-best result of the 81 funds in the sector with a long enough track record.

In addition to six periods in the top quartile for information ratio, the £2.1bn fund has spent four periods in the second quartile and the remaining one period in the third quartile.

Managed by Bhavin Shah, Simon Nichols and Paul Flood, BNY Mellon Multi-Asset Growth uses a global thematic approach that aims to identify investment opportunities linked to the ‘big picture’ drivers of economics, markets and companies.

The majority of this portfolio is invested in equities, with Microsoft, AstraZeneca, RELX, Samsung and BAE Systems being among the largest holdings at present.

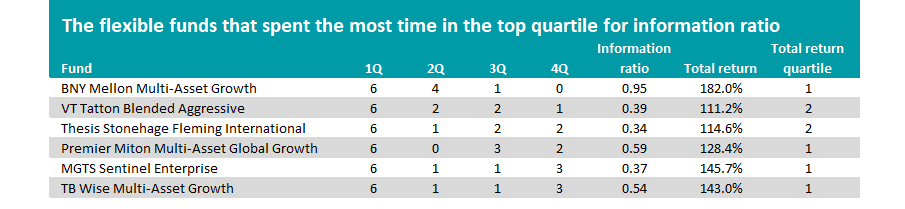

As noted above, there were another five IA Flexible Investment funds that have been top quartile for information ratio in more than half of the 11 periods under consideration and they can be seen in the table below.

Source: FinXL

VT Tatton Blended Aggressive appears in second place as it has six periods in the top quartile and two in the second, only falling into the bottom quartile in one of the periods (2018). While the BNY Mellon fund is the largest on the list, this one is the smallest with assets of just £30m.

The fund has an unconstrained approach and uses a mix of active and passive funds. The approach used by the management team revolves around ‘portfolio stewardship’, or ensuring that portfolios are “aligned to the desired long-term investment objectives in the face of a constantly changing world”.

It has the lowest total return of the six funds to make it onto this research’s shortlist, although its 111.2% return since the start of 2013 is still comfortably ahead of the 84.1% made by its average peer.

Four of the funds – BNY Mellon Multi-Asset Growth, VT Tatton Blended Aggressive, Thesis Stonehage Fleming International and MGTS Sentinel Enterprise – have achieved top-quartile information ratios over 2023 so far.

However, the remaining two – Premier Miton Multi-Asset Global Growth and TB Wise Multi-Asset Growth – fell into the bottom quartile for the metric over this more recent period.

The other articles in this series on the information ratio, follow this link.