The opportunity from investing the Scottish Mortgage way (focusing on disruptors that will be the next market leaders) is not what it was 10 years ago, according to veteran FE fundinfo Alpha Manager Tom Slater. In fact, it's “all the greater today”, he said, as “huge swathes of the economy are experiencing disruption and new approaches”.

Future disruptors – both listed and unlisted – come in many shapes and sizes. Below he selects some favourites from the trust’s portfolio.

The first up is one of the largest holdings, Moderna, which makes up 7.3% of Scottish Mortgage. This company became a household name thanks to its Covid vaccine, but in December, the company demonstrated that its approach could be used to make personalised cancer vaccines, the manager explained.

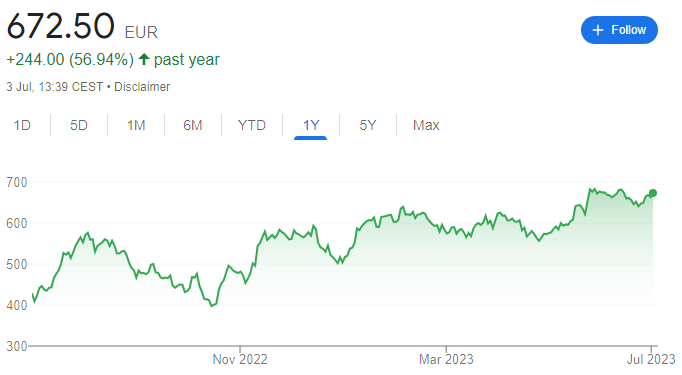

Performance of Moderna over 1yr

Source: Google Finance

“Phase-two trials in advanced melanoma showed a 44% increase in survival for those taking the vaccine as compared to the current standard of care, which led to the pharmaceutical giant Merck paying $250m to Moderna to co-develop that programme.”

“We're excited about launching phase-three trials of these vaccines and various cancer types over the remainder of this year. Moderna now has 13 vaccines for infectious diseases in the clinic. And with the addition of therapies for cancer, for liver disease, or lung disease, the number of potential applications of this technology is multiplying.”

Another favourite is Nvidia, a Scottish Mortgage holding since 2016 (making up 4.2% of the portfolio today). As many investors will know, it is a key supplier of semiconductors and “enjoys some formidable advantages”, as the chip technology, which it's built over the decades for computer games, has proven ideally suitable to artificial intelligence (AI) computation.

But the trust’s plays in this sector don’t stop here, encompassing ASML (8.6%) and Tesla (5.2%) too.

Performance of ASML over 1yr

Source: Google Finance

“The semiconductor industry generally depends on ASML's exceptional engineering skills to produce cutting-edge chips. Artificial intelligence is just one driver of the strong demand that we expect for that company over the next decade,” said Slater.

“Tesla rolled out access to its full self-driving capability across the US last year and it's now driven 150 million autonomous miles, providing it with a vast data advantage over the rest of the industry.”

Moving on to unlisted companies, the largest private holding in the portfolio is SpaceX (3.5%), whose reusable rockets made the commercial space market a reality.

“SpaceX made 60 launches in 2022, that's more than one per week and more than twice the number it did in 2021, as its has reduced launch costs by around 95%,” Slater said.

“We're now starting to see consumer applications appearing. For example in the United States, T-Mobile has started a joint venture with SpaceX to eliminate mobile dead zones across the continental US. Over time, other space-based applications will become more common.”

In the electrification space, Europe “still has to respond with some kind of equivalent strategy to the US’s Inflation Reduction Act”, which is designed to incentivise companies to produce goods in the US, “if it wants to avoid all of the industrial capacity being built elsewhere”, said Slater. And it could start with Northvolt, the unlisted European battery manufacturer (3.3% weighting).

“Northvolt made its first commercial deliveries in 2022 as its production facilities in northern Sweden ramped up,” he said.

“The company is tapping into enormous latent demand for electrification, has announced $55bn of contracts with the largest auto manufacturers and is scaling up rapidly outside Sweden to meet the industry's needs.”

However, future leaders in electrification and electric vehicles are now “far more likely to come from Chinese manufacturers that you've never heard of, like BYD, than from Ford or General Motors”.

“It's really quite astonishing, it's clear that they are a long way ahead of us down this path to electrification,” he said.

The manager significantly reduced some of the trust’s Chinese holdings last year, but still has about £1.8bn invested in China.

“It was encouraging to see the holdings that we have there start to grow again, as lockdowns fade away and the regulatory environment has become a lot more business-friendly,” Slater said. “In fact, it was the Chinese e-commerce company Pinduoduo that was our best-performing stock in 2022.”