Japan is back on investors’ radar after decades of being unloved, with the Nikkei 225 reaching a 33-year high this year.

In addition, Japanese equities received Warren Buffett’s seal of approval when he visited Japan in April to announce that Berkshire Hathaway would increase its investment in Japan. The company doubled down by increasing its stakes in five Japanese businesses this week.

For investors interested in walking in Buffett’s steps and increase their exposure to the country via a close-ended fund, Baillie Gifford Japan Trust (BGFD) and JPMorgan Japanese IT (JFJ) are two possible options that share a few commonalities.

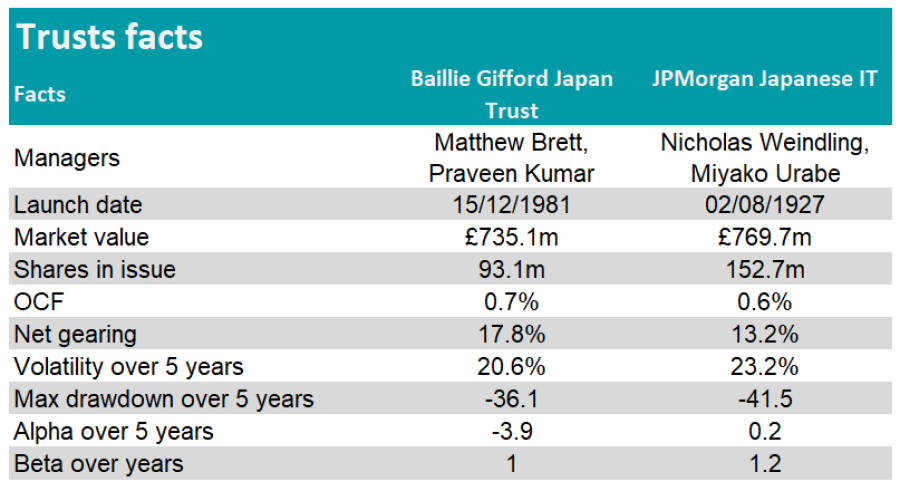

Both have a tilt towards growth stocks, a similar ongoing charge figure (0.66% for BGFD and 0.61% for JFJ) and roughly the same size (£735m for BGFD and £770m for JFJ).

James Carthew, head of investment company research at QuotedData, added: “Both managing teams have a long-term buy-and-hold stock-picking approach.

“Turnover on the funds is about the same. JFJ’s list of 10-largest holdings rarely changes and its largest position has featured in JFJ’s portfolio since 2011.”

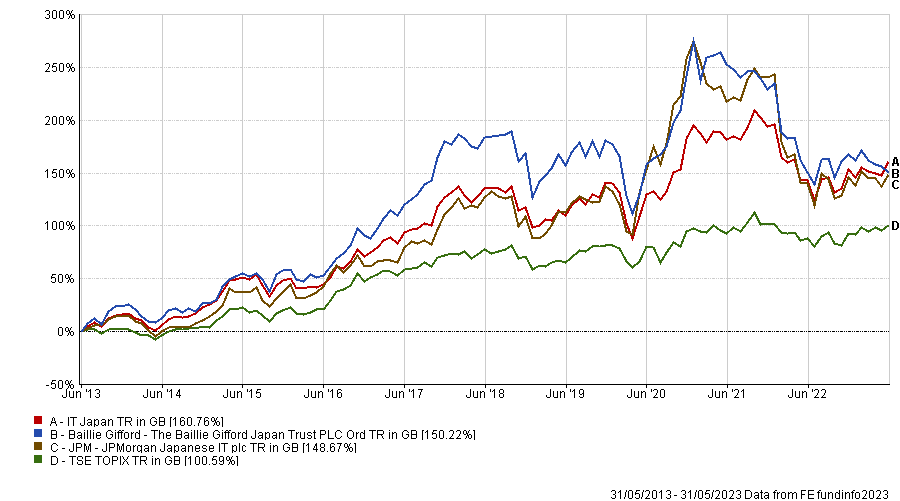

Trusts’ performance vs sector and benchmark over 10yrs

Source: FE Analytics

Over the last 10 years, both funds have underperformed the IT Japan sector albeit beating the TOPIX index.

Carthew said: “For many years, BGFD was the leading performer in its sector, but that hasn’t been true for quite a while now.

“About two years ago, the top slot was held by JFJ, now the sell-off in growth stocks has dented both funds’ returns.”

As a result, both trusts are currently trading at a discount, which could be an interesting entry point for investors, especially with the current tailwinds for Japanese equities.

Josef Licsauer, investment analyst at Hargreaves Lansdown, said: “Both trusts have attempted to manage the discount volatility over the last 12 months, through share buybacks. These actions have meant each discount has remained more stable and offers clients potential attractive entry points.

“Japanese businesses are publishing strong reports and some of the operational performance hasn’t yet been factored into the share price / growth prospects. While the discount could widen and wider economic events could add additional pressure, it could be a good time to enter the market.”

Trusts’ facts

Source: FE Analytics

Despite those similarities in style, size and charges, both trusts tend to target different types of businesses.

Emma Bird, head of investment trust research at Winterflood, said: “JFJ has an all-cap investment approach, whereas BGFD focuses principally on small- to medium-sized firms.”

While both portfolios have a high active share (meaning that they are notably different from their benchmark), Bird added that they only have an 18% overlap of common holdings.

In addition, the managing team of the JPMorgan Japanese trust has been in place for longer. Nicholas Weindling has been at the helm of the trust since 2007 and was joined by Miyako Urabe in 2019.

In comparison, Matthew Brett and Praveen Kumar have been managing Baillie Gifford Japan since 2018, replacing Sarah Whitely who retired after 17 years as head manager of the trust.

Which trust do experts prefer?

While both trusts look to achieve growth through Japanese equities, they do so in distinctive fashions. Therefore, they play a different role in a portfolio.

Carthew had a slight preference for the JPMorgan trust.

He said: “When comparing the two funds, the only significant difference is in the stocks that have been selected for their portfolios and JPMorgan Japanese IT has just done better than Baillie Gifford Japan Trust, especially since the manager change on Baillie Gifford Japan Trust.

“There isn’t much difference in their ratings (BGFD 9.1% discount, JFJ 7.3%). On balance JFJ looks the better bet.”

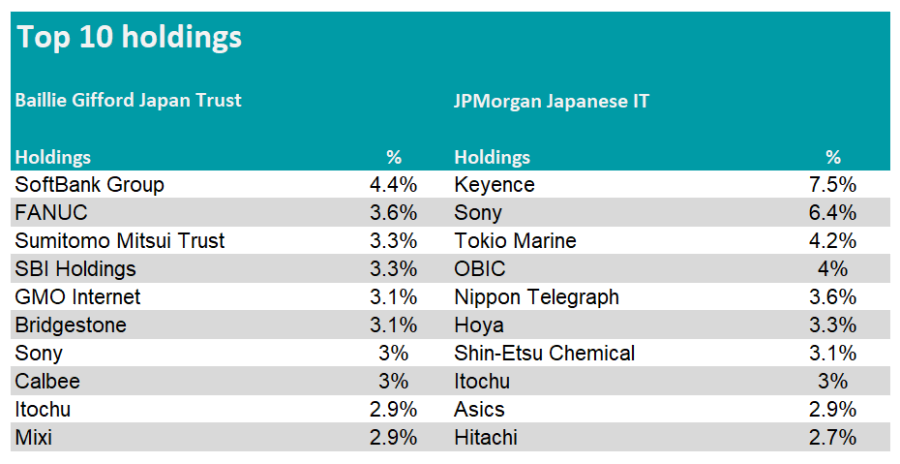

Top 10 holdings

Source: FE Analytics

Chris Salih, investment trust research analyst at FundCalibre, said the JPM trust is the safer option but that the Baillie Gifford one has more upside potential.

He said: “A lot depends on whether you believe small- and mid-caps will rally in Japan.

“The JPM trust is probably the safer bet, but if you are confident over the long-term, the Baillie Gifford trust can make serious gains – but it needs to as returns have been poor regardless of market conditions.“

Winterflood expects both funds to outperform the benchmark over the long term if sentiment towards growth investing is favourable and the Japanese rebound is to continue. Yet, Bird had a slight preference for the Baillie Gifford trust.

Bird said: “Both are currently trading at a discount, although we note that the JPMorgan Japanese IT has historically traded at a lower rating.

“Hence, whilst both funds’ boards have been active in buying back shares to mitigate their current discount, we view the Baillie Gifford Japan Trust to have a greater scope for a re-rating, especially given its more retail-oriented shareholder base.”

Licsauer also had a preference for the Baillie Gifford trust, due to the larger diversification and lesser concentration in the top investments, also noting that the fund has been historically less volatile than its rival.

Yet, he warned that neither trust is adequate for a core exposure to Japan: “If you were looking to increase exposure to Japan, investing in these two trusts might not be the best bet.

“The sensible route would be to invest in one trust and pick another fund or trust that offers more in the way of diversification, like a Japanese income fund or strategy focused on value investing.”

With the change in corporate governance code and the Tokyo Stock Exchange requiring firms with a price-to-book ratio below 1x to make clear how they can improve their share price rating, Hawksmoor prefers the opportunity in Japanese small-caps, in particular via activist investors.

Dan Cartridge, assistant fund manager at Hawksmoor said: “In the investment trust space we have favoured Nippon Active Value Fund and AVI Japan Opportunity Trust.”