There are some UK banks that have been thrown out with the bathwater following the collapse of Silicon Valley Bank (SVB), according to experts.

The collapse of the US bank caused shockwaves through the market, with investors concerned that it could trigger the next global financial crisis.

A week later, news that UBS was taking over the troubled Credit Suisse also rocked markets, with the under-pressure European bank previously deemed too big to fail.

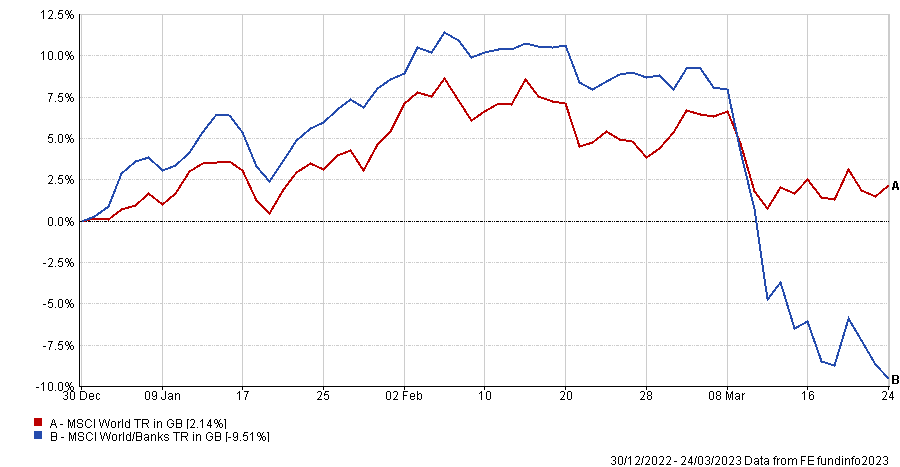

This combination has been a disaster for bank stocks. While equities more broadly have been largely unscathed (the MSCI World remains up 2.1% so far this year), the MSCI World Banks index has tanked, down 9.5% since the start of 2023.

Performance of indices over YTD

Source: FE Analytics

Justin Bisseker, European banks analyst at Schroders, said: “Banking is really a confidence game. There is no bank in the world that can survive if every single depositor goes in and pulls out their money. That's where good regulation and prudence are crucial.

“It's politically unacceptable for depositors to lose money. And so you have to be sure that you have a system that works, where depositors don't lose money, and where the government doesn’t have to step in.”

However, Jonathan Harris, global credit investment director at the firm, said the current situation is very different from 2008, as banks are generally more conservative and have more liquidity.

“Nevertheless, confidence has clearly been shaken, and so it remains important that all of the relevant authorities address the perceived weaknesses in the banking system to restore that confidence,” he said.

Neil Veitch, global and UK investment director at SVM Asset Management, warned that investors should expect the volatility in the banking sector to last for a while, but noted that there are now opportunities for those brave enough to wade into the financials waters.

“Bank share prices are likely to remain volatile in the near term, subject to changes in prevailing sentiment. In the longer-term, however, the UK banking sector is well capitalised with excellent liquidity,” he said.

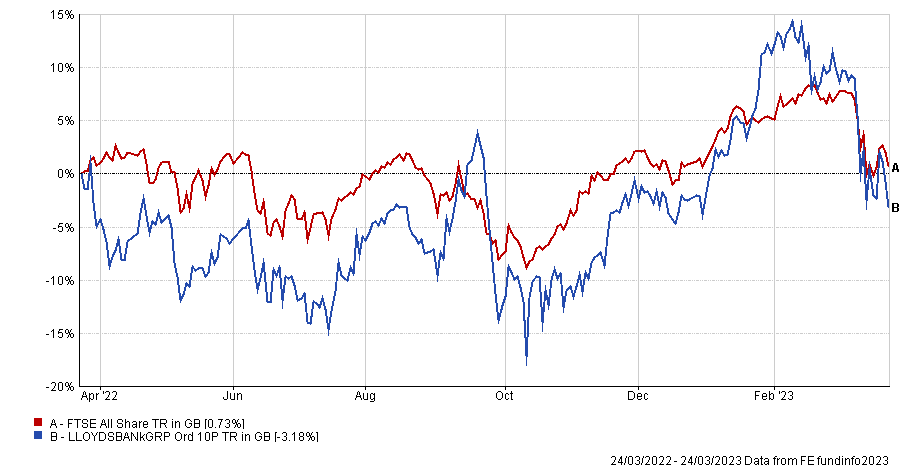

“Although changing depositor behaviour may ultimately impact margins, this is already reflected in valuations. Lloyds Banking Group, in particular, stands out to us due to the strength and depth of its franchise.”

Performance of Lloyds vs FTSE All Share over 1yr

Source: FE Analytics

Aruna Karunathilake, co-manager of Fidelity UK Select, agreed that Lloyds, which includes brands such as TSB and Halifax, was a good option for investors. He holds the group in his fund.

However, he was also keen on NatWest Group, which also houses the Royal Bank of Scotland (RBS) and Coutts brands.

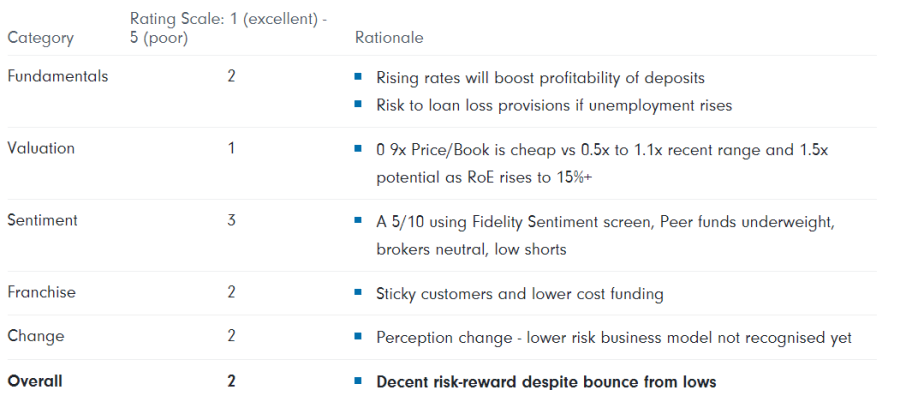

“When assessing NatWest using our scorecard methodology, we score the fundamental outlook as being positive given the interest rate tailwind discussed above, while being alert to the risk that rising unemployment would bring if the UK’s current labour shortage turns into a glut driven by a marked contraction in economic activity,” he said.

Fidelity scorecard for NatWest

Source: Fidelity

The preferred valuation metric he uses is the price to book. Here NatWest trades at 0.9x, although the manager said it should be around 1.5x as there is a 14-16% expected return on equity.

“It is equally attractive when looking at other metrics with the stock trading on a price-to-earnings ratio of just 6x, while offering a 6% dividend yield which will grow over time,” he said.

Together with Lloyds, the banks make up around 10% of his portfolio. “Having assessed the impact of recent events, we are comfortable with our position while remaining alert to the risks posed by a recession and rising unemployment,” said Karunathilake.

“We believe dominant retail banks are good quality businesses capable of once again generating attractive returns on equity with a moat comprised of sticky customers (people rarely move their current accounts) giving them a funding advantage over smaller peers as evidenced by events in the US – money is not flowing out of JP Morgan.”