Funds offering exposure to dividend-paying companies have been popular among investors over the past year as the cost-of-living crisis has put a strain on people’s budgets.

Indeed, the IA Global Equity Income sector was the only group to attract new money in every month of last year, generating a total inflow of £2.8bn in 2022.

An extra source of revenue in this high inflationary environment is appealing, but with so many equity income funds on the market investors may not know where to start.

Here, Trustnet asks industry experts what to look out for in an income fund and what traits to avoid if investors want dividends.

Investors will typically gravitate towards funds offering a high dividend yield, but this is often a red flag, according to Adam Carruthers, analyst at Charles Stanley.

Companies offering a large pay-out have little room for dividend growth and may even be at risk of cutting their yields to a more achievable rate. Carruthers said that investors should steer clear of funds investing in these companies to boost their own yield.

A good way to see if a fund is guilty of this practise is to look at its UK allocation, according to Carruthers. The UK market is famed for its high dividend payers, but many of them have reached a limit on how high they can bring pay-outs.

Carruthers said: “Many wealth managers in the UK are obsessed with the highest dividend yielders and only the largest UK-listed companies. This is folly.

“The highest yielders are usually clear indications of a company in decline or distress. Classic value traps.”

The ideal income portfolio would instead diversify its assets globally and offer exposure to dividend-growing stocks from a range of markets, according to Carruthers.

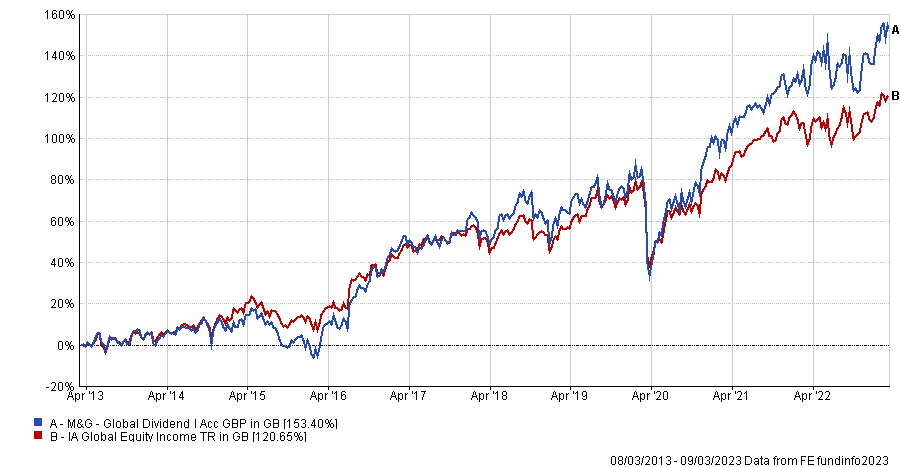

He said that one fund that ticks all the boxes is M&G Global Dividend. The £2.4bn portfolio yields 2.19% and returned 153.4% over the past decade, beating the IA Global Equity Income sector by 32.8 percentage points.

Total return of fund vs sector over the past decade

Source: FE Analytics

It is also worth looking at how frequently a fund pays out dividends to investors, as this can be a good indicator of its income discipline. James Yardley, senior research analyst at Chelsea Financial Services, said that he prefers funds that pay dividends on a monthly basis.

A fund that doesn’t have a concerningly high yield and pays out its dividend frequently makes for a perfect pairing, he added.

Yardley said: “Don't just look for the funds with the highest yield. It’s much better to start with a slightly lower-yielding strategy but then have it grow every year, than start with a high-yielding strategy which goes nowhere or cuts its pay-out in the future.”

With rates on some one-year cash savings accounts offering rates of more than 4%, it may be tempting to try and find a higher yield on an income fund. Chasing the highest yields would be a mistake though, according to these experts.

Yardley added: “It is best to avoid the very highest yielding funds. Some funds run maximiser or enhanced strategies. This boosts your income but at the expense of capital growth.

“In our experience you've generally had to give up too much in the way of capital to justify the higher returns.”

Investors may look to beat the rates of 4% and upwards from cash savings accounts, but people should question funds offering yields above 4.5%, according to Ben Yearsley, director at Fairview Investing, who agreed with Carruthers.

“Quite simply the higher the income, the less chance of both capital growth and growth in income, and over the longer term, investors probably need and want both,” he said.

Other than looking at what stocks the fund is holding, investors could also benefit from keeping an eye on when the manager is buying them.

The ex-dividend date is the last day that someone can buy a stock and still be entitled to the next dividend payment.

If a fund manager is “playing tricks by buying stocks just before they go ex-dividend,” they may be trying to add poor companies to boost the fund’s income, according to Yearsley.

He added: “None of these on its own is a red flag just simply answers you need to know questions to prior to investing.”