The Bank of England has raised rates by 0.5 percentage points to combat stubbornly high inflation, despite fears the UK is falling into recession.

At 3.5%, rates are now at their highest level since October 2008, although the latest increase is a step down from the 0.75 percentage point hike last month.

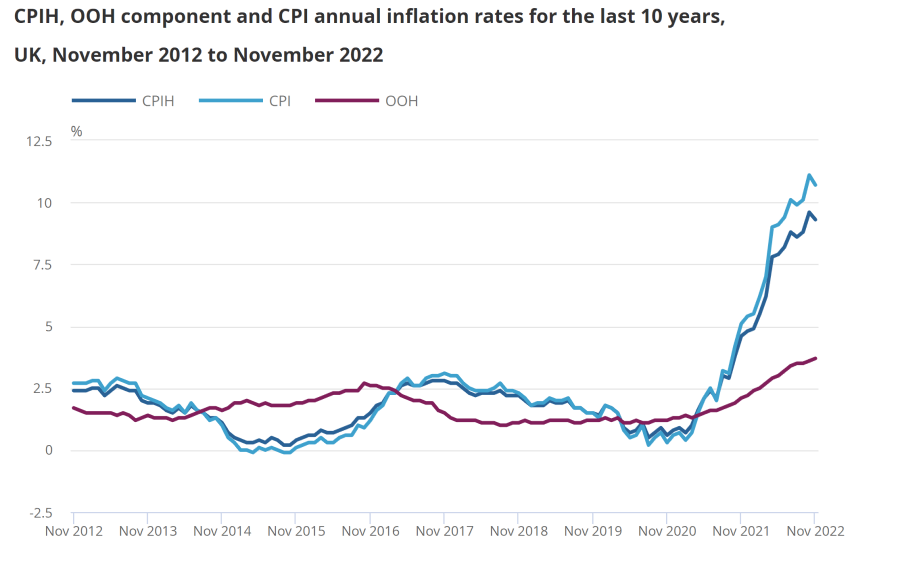

It comes after inflation dipped last month, down to 10.7% from 11.1%, while unemployment ticked higher to 3.7%, although it remains very low by historical standards.

Hussain Mehdi, macro and investment strategist at HSBC Asset Management, said the Bank finds itself “in an increasingly tough spot” as it couples an emerging recession and financial stability concerns with ongoing wage pressures that risk embedding inflation.

“A downshift to 0.5 percentage points is sensible and we think the MPC [Monetary Policy Committee] will tread a more cautious path in 2023 as it assesses the impact of previous tightening on a weakening economy.”

Marcus Brookes, chief investment officer at Quilter Investors, said the latest development was good news for households and the economy as it looks as though inflation “may have peaked”.

“This does not mean the end of the rate hikes though and, just like the Federal Reserve over in America, the BoE will keep hiking until it is sure inflation is on a sustained downward trajectory,” he said.

Investors will start looking to the future, with eyes “potentially even looking at when rates might even be cut in order to stimulate economic growth”.

However, with the jobs market “the only thing keeping the UK from entering a truly stagflationary environment”, the BoE faces a “tough balancing act” between keeping the upcoming recession shallow while also arresting rising prices, said Brookes.

Les Cameron, savings expert at M&G Wealth, said with many people feeling the financial pinch, what’s important is how today’s interest rate hike impacts savings and borrowing rates.

“Even with an increase in rates, when coupled with sky-high inflation, anyone with cash or near cash savings will see their money being eroded in real terms. And this is likely to be felt more acutely by pensioners who are likely spend a higher proportion of their cash savings on energy bills,” he said.

Rachel Springall, finance expert at Moneyfacts, said the latest rate rise will be disappointing news to borrowers who are already facing a cost-of-living crisis, but savers “may be pleased” to see rates rise across variable cash accounts.

However, she warned that there is “never a guarantee” that base rate rises will be passed on to savers. “In fact, the majority of the biggest high street banks have failed to pass every Bank of England base rate rise to easy access accounts over the past year,” she said.

The Bank of England’s rate increase comes after the Federal Reserve last night stuck to its guns and raised rates by 0.5 percentage points despite lower-than-expected inflation figures. It brought to an end successive 0.75 percentage point rises but was an expected move by the US central bank and takes the rate to 4.25-4.5%, the highest since 2007.

George Lagarias, chief economist at Mazars, said: “The Fed’s decision to reduce the pace of rate hikes has been well communicated in advance and comes as no surprise.”

However, he warned that investors should not get too excited by the developments and view this as the beginning of a U-turn. “Having said that, markets seem convinced that the ‘pivot’ towards more accommodation is in hand. It is not,” he said.

“Quantitative tightening picked up significantly in November. The ‘pivot’ is in fact drawing away, as pressures from bond markets abate and the financial system is proving resilient.”

Chris Beauchamp, chief market analyst at IG Group, said markets had been “caught on the hop” by the downgrade to GDP forecasts for 2023 and a higher rate of inflation by the end of 2023.

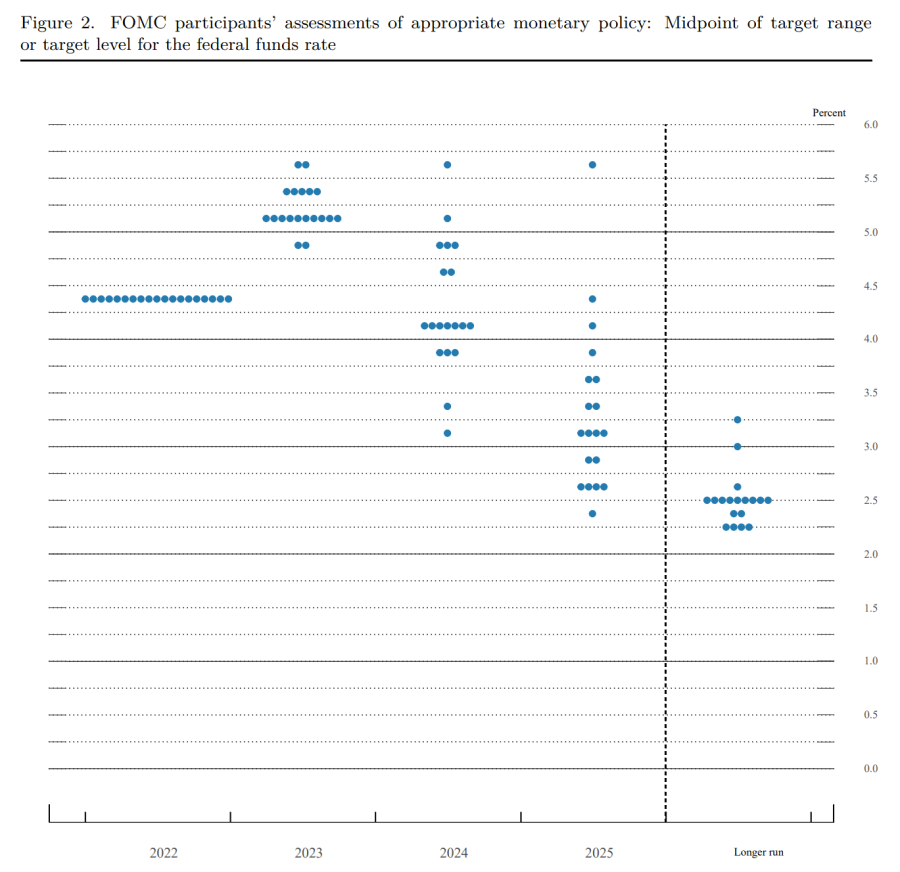

“Two officials see negative GDP growth in 2023, and the overall expectation has been cut 0.5%, which is dangerously close to a consensus recession call. Meanwhile, price growth is forecast to be 3.5% compared to 3.1% in September, suggesting that the Fed will have to push on with more rate hikes than currently expected,” he said.

Source: Federal Reserve

However not all agreed. Gerrit Smit, manager of the Stonehage Fleming Global Best Ideas Equity fund, said: “This is a clear indication that we are entering the later stage of Fed tightening.”

It follows five months of lower US inflation, which currently stands at 7.1% having peaked in June at 9.1%. Although the Fed’s own dot-plot chart – a measure of implied future rates – suggests more hikes to come, with inflation calmed he said that we may be near the end of Fed tightening, which could lead to better market returns next year.

“Historically the S&P 500 delivered on average double digit 12-month returns since the beginning of the last six months of Fed tightening,” Smit said.