Boutique fund house Evenlode Investment Management is mostly known for its flagship £3.2bn Evenlode Income fund, a top-quartile performer over the long run in the IA UK All Companies sector.

The second fund it launched, Evenlode Global Income, also reached a considerable size at £1.2bn while the investment house launched its third product - Evenlode Global Equity - in July 2020.

This latest addition to Evenlode’s stable is its smallest with £48m assets under management and the least-known fund so far, but the philosophy and investment strategy are established and have proved successful.

Below, Trustnet puts a spotlight on Evenlode Global Equity for those investors who think this newer fund might have the potential to rise to the level of its predecessors.

The fund shares investment philosophy and process with its bigger siblings – with some crucial differences, as co-manager James Knoedler explained.

“The previous funds we have launched, Income and Global Income, come with a set of restrictions; to own 80% of UK listed stocks, to pay out dividends to unit holders and yield restrictions. The Global Equity fund, having accumulation units only, allows you to look at a somewhat different pool of companies to the previous strategies.”

However, process and strategy remain the same.

“We focus on quality, finding companies with good return on capital, competitive advantage and a valuation discipline as well, which isn’t commonly found among our global equity peers. Those who do use valuation systems tend to use traditional ones,” Knoedler said.

Traditional systems to calculate valuations are sometimes distrusted because they require analysts to assume the value of cost of capital, with results that can vary widely based on such assumption.

Evenlode, however, uses a reverse discounted cash flow model, which removes the guesswork of estimating future cash flows. It starts with a company’s share price, which is known, rather than estimating future cash flows, which by their nature are unknown.

Essentially, if the current price of a stock needs more cash flows than the company can realistically produce to justify it, then it is overvalued; it is undervalued if the opposite is true. Knoedler argued that this means the resulting valuation of the reverse discounted cash flow model is much more reliable.

Co-manager Chris Elliot described the valuation system having a bias towards companies which have good investment levels and a very good, long runway ahead.

“With this method, we don't need to be scrambling around to find the cheapest possible valuation to get the bump when you get reversion. What we do instead is consider how good a business is and whether we can trust the management team, but we are also price-aware. We invest at a reasonable price and then just let the company do the work,” he said.

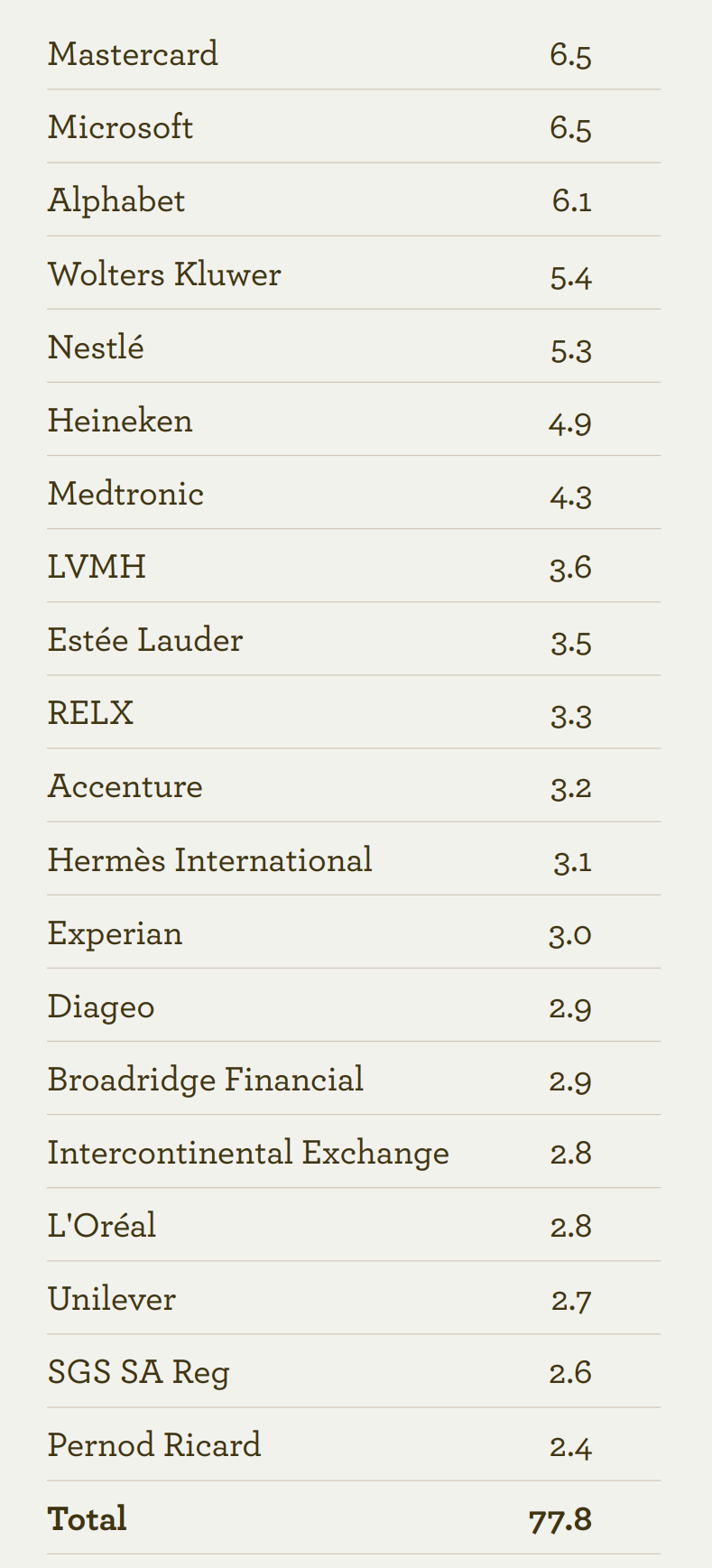

Fund’s top 20 holdings as of 30 September 2022

Source: Evenlode

In terms of the portfolio, Evenlode Global Equity is primarily invested in developed market-listed companies.

These tend to be multinationals, such as Unilever and L'Oreal, which generate revenues all around the world.

“We can count on a good exposure to emerging markets by picking really high-quality businesses that don't take much single-market risk or governance risk, which you typically get in emerging markets. We have a 20% exposure to Asia Pacific in underlying revenues and a 10% to Latin America and Africa,” said Elliot.

The fund’s primary exposure (36.3%) is to the US telecom, media and technology space, which suffered tremendously in 2022, as investors have been preferring cheaper stocks. Evenlode Global Equity, however, managed to contain the losses.

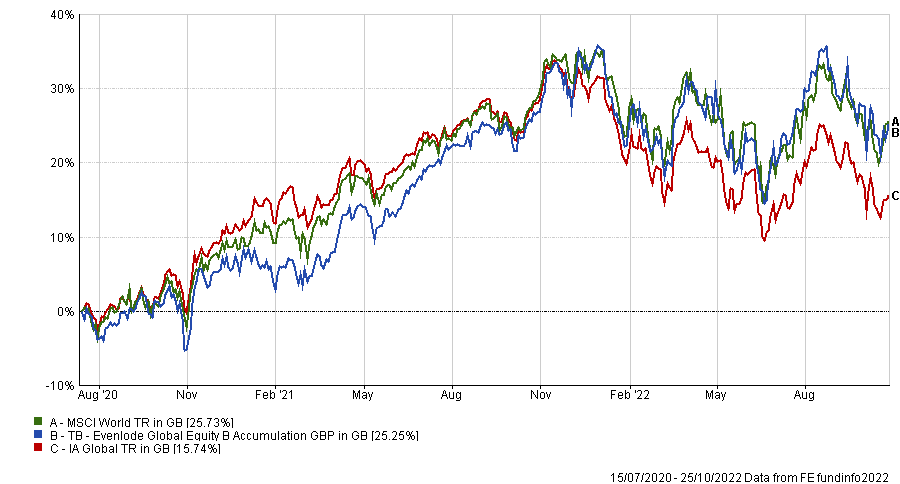

Performance of fund since launch vs index and sector

Source: FE Analytics

As shown in the graph above, Evenlode Global Equity has had a good run since its inception, outperforming its IA Global sector by 10 percentage points. It has also delivered first-quartile performance over one year and six months but dipped into the second quartile over more recent time frames.

The weakness of the pound against the dollar provided some short-term tailwinds, co-managers Chris Elliott and Knoedler admitted, which might have prevented the fund from significantly falling below its benchmark in the revolutions of the market of the past year.

Additional short and mid-term opportunities might still come from the UK, the managers said.

“The UK has underperformed quite a lot and with the currency weakness we are seeing some good valuation opportunities at the moment.”

The fund’s exposure to the UK is currently around 12%.

But Elliot and Knoedler also see positive signs elsewhere, if investors are ready to take a long-term perspective.

“Tech valuations have come off a lot, and while the market could potentially fall further, there are some sub-sectors with enough growth and potential to rise all boats. Some fintech companies and hyperscalers are very resilient businesses and this could be a very attractive entry point in this space. We are fairly confident with their long-term picture,” they said.

“We firmly believe that the long-term effects of developed-market currency movements will be dwarfed by company performance in driving fund returns, and as such our efforts remain focused on identifying businesses with durable competitive advantages and opportunities to reinvest for long-term growth.”