The Fidelity Sustainable Global Equity fund has been a top-quartile performer over the past five to 10 years in the IA Global sector, benefiting from an increasing appetite for environmental, social and governance (ESG) investing.

Indeed, over the past decade it has made a total return of 234% in the past decade, beating its peer group by 65.1 percentage points.

However, the investment area has come under pressure this year, as investors have moved away from traditional growth stocks that line ESG funds and into ‘value’ companies, such as oil and miners, that typically tend to score poorly for ESG.

Below, manger Jamie Harvey explains why valuation is still key for sustainable investors and why he holds “controversial” stock Amazon.

Total return of fund vs benchmark over the past 10 years

Source: FE Analytics

What’s your investment strategy?

The process is really all about finding not just great companies but also great investments.

In practice, that means finding that small handful of companies that not only make very significant positive impact on the world through their products and services, but also have financial valuation characteristics that you need to make a great investment.

How do you stand out from your peer group?

A key fundamental to us is valuation, which I think we pay a little bit more attention to than some of our sustainable peers.

In order to have an investment in that sustainable universe, I think people have felt they needed to sacrifice some of that valuation discipline to own the best companies.

Up until the start of this year, the types of companies we're talking about traded at pretty high multiples versus their own history and in absolute terms but sacrificing valuation discipline is never a good route to go down.

Is it tricky holding Amazon as an ESG manager?

I think Amazon is probably the most controversial holding we have and the reason we own it if for Amazon Web Services (AWS).

Cloud-based computing is roughly 95% less carbon intensive than on-premises servers, so AWS is extremely efficient from both a financial and environmental point of view.

Amazon is decarbonising massively, which has a very meaningful difference on global carbon emissions, but clearly the debate is mostly around the retail part of the business.

I think we take some comfort from the fact that it clearly is making very big strides on the social side of the business, but is by no means perfect and there remains a lot more work to be done.

How are you pushing the company to improve?

Through engagement, you can't really change what a company does but you can change how it does it.

We’re continuing to push Amazon to improve on working relationships with employees through paid time off, parental leave and making sure that there's paid sickness, which is sadly not a standard thing in America.

A big topic we plan to engage with is union relations – it is attempting to block unionisation in certain aspects of the US business and we're encouraging the firm to consider its policies there.

It is making big strides on the environmental side, so it’s more about encouraging the management team to keep up the pace as opposed to asking to change what it is doing.

What’s the biggest challenge facing the fund?

The derating of quality businesses is a challenge for us. Whilst we may be less exposed than some of our peers, we are still more exposed than the benchmark.

The rising cost of capital and increasing real rates has put pressure on more highly valued businesses so that has been a problem for relative performance.

That’s something we’re trying to manage but we’re mindful of that fact that it is really an output of our investment process.

A focus on quality prospects means that you're likely to be owning better than average businesses that trade at higher than average multiples, but it does mean there will be more of a challenge in certain periods and that's what we're going through at the moment.

Another challenge has been our overweight to Europe, which has clearly gone through a tougher spot from a macro perspective than other regions.

How have you combatted those challenges?

The fund hasn’t changed a great deal because it has a very clearly defined investment process, so the types of stocks that come out don't change dramatically.

One change that is notable over the past six months is an increase in our weights to utilities – we appreciate the macro environment that we face so slightly increased our defensive positioning through allocations primarily to utilities but also a little to healthcare.

The way we mitigated our exposure to Europe is by investing in very global businesses that happened to be listed in Europe. They still get caught up in the overall outflows from European equities, but it does mean that ultimately the fundamentals of those businesses are still very strong in the long term.

What has been your best performing stock over the past year?

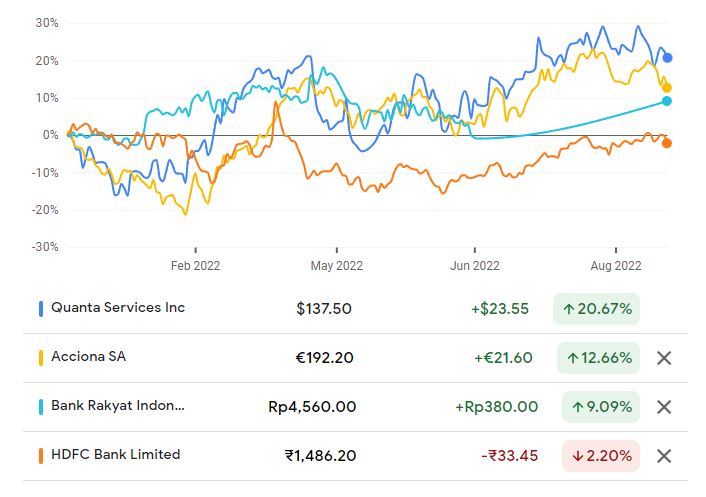

When looking at leaders over the past year, the common names that appear are renewable-linked businesses like Quanta Services in the US and Acciona in Spain, which have performed extremely well relative to the benchmark.

Quanta has contributed 100 basis points year-to-date and Acciona contributed 80 basis points, so pretty meaningful contributions.

Emerging market banks have also done really well – two big contributors have been HDFC in India and Bank Rakyat in Indonesia, which together contributed more than 100 basis points on account of the rising rate environment

Share price of companies in 2022

Source: Google Finance

What have been some of your worst performers?

When I look at the stocks that have really held us back this year, it's a mixture of European rate sensitive stocks and cyclicals.

These are companies like Veolia, which is a French waste and water business and Epiroc, which is a Scandinavian mining equipment business. They both detracted 35 basis points this year.

These are all stocks that have either a lot of cyclicality to European macroeconomics or have significant rates sensitivity in their valuation. For some of them, the fundamental outlook has changed now that Europe has a tricky 12 months ahead.

We’ve had to take a step back and think ‘has the long term changed and what am I willing to put up with in the short term to hold this stock?’

We haven't sold any of those because we're still very confident in the long-term potential of those businesses but the short term is more challenged than we had expected at the start of the year.

Share price of companies in 2022

Source: Google Finance

What are your interests outside of fund management?

My dad was a professional racing driver, so I grew up going to racing tracks every single weekend with him and what I love now is electric motor sport – I find it fascinating.