As Covid and the war in Ukraine hike up prices around the world, central banks are caught in an impossible balancing act between inflationary risk and the risk of a recession.

Last week, the Federal Reserve (Fed) seemed to choose one over the other, as it raised interest rates by 75 basis points (bp) instead of the previously expected 50bp in the hopes of easing inflation. In Europe, the Bank of England (BofE) and other central banks are following suit.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown, said there was an initial injection of optimism at these moves, but what followed was a “sinking feeling” that hit the financial markets, as worries rose that countries around the world would not be able to avoid falling into the economic pit of recession.

“The mood soured on Wall Street as concerns mounted that the price spiral was going to be an even harder nut to crack, without fresh aggressive hikes”, she said.

Stephen Innes, managing partner at SPI Asset Management, agreed: “No matter how high the Fed drives interest rates, inflation does not decline. The market does not think the Fed will be able to cut in the face of persistent inflationary pressures.”

In the current scenario, with the Fed “rate hike locomotive on the track” and eroding growth opportunities, investors are looking for safer assets than equities.

Bonds have traditionally been one option and they have lately been the subject of booming interest, with JP Morgan recently backing fixed-income and Trustnet looking at where to find the best credit opportunities.

But they are becoming increasingly volatile.

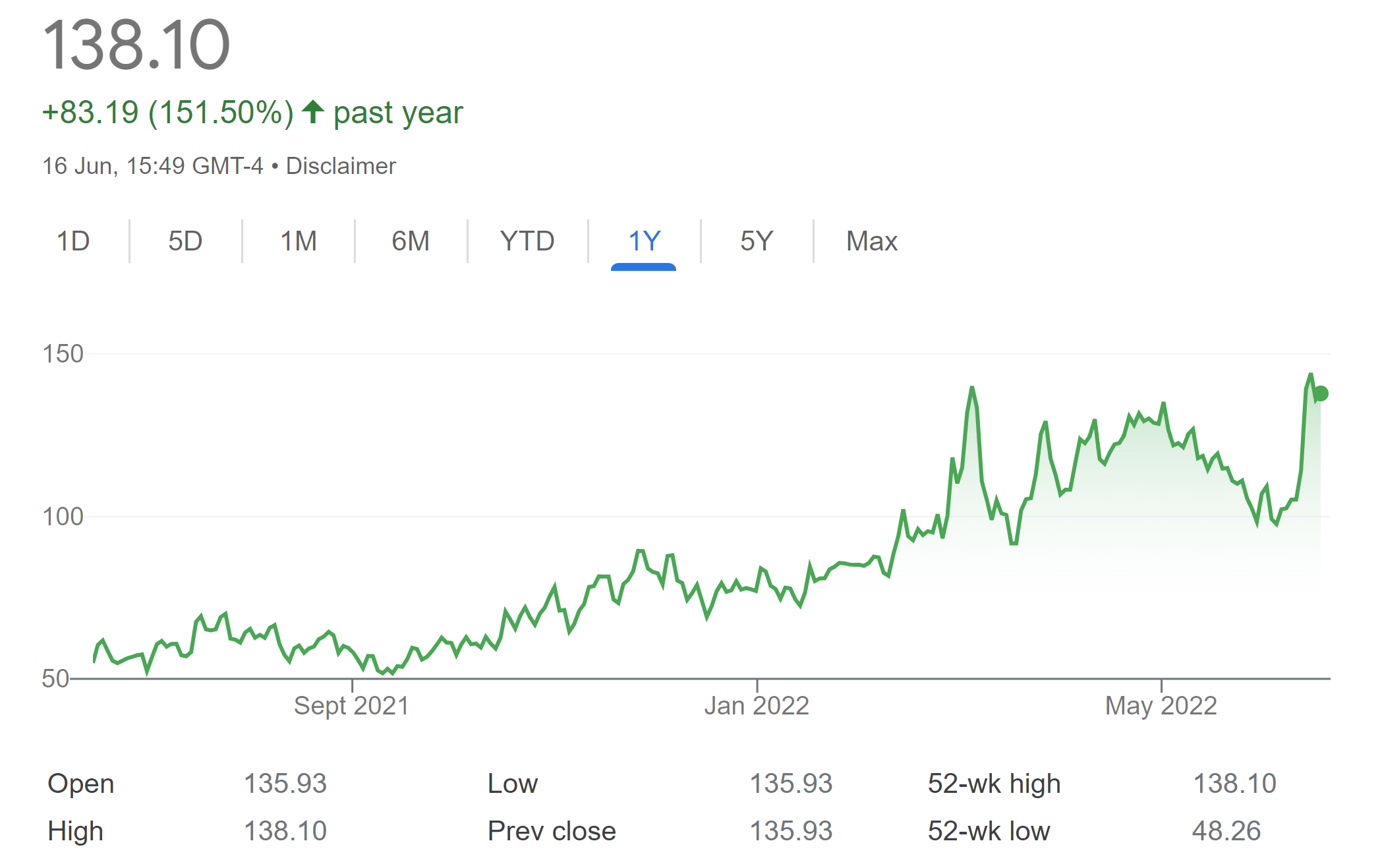

Since the beginning of the month, the Merrill Lynch Option Volatility Estimate (MOVE) index, which is linked to 1-month US-Treasury options, has increased by 40 points, as shown in the chart below.

MOVE index past month’s performance

Source: Google Finance

Concerns around interest rates are so high, that the MOVE index is higher than it was after the last round of Fed repricing in April and higher than in late February when Russia invaded Ukraine.

In fact, it is only 20 points away from the peak reached during the market dislocations of March 2020, as Innes highlighted.

Analysts and investors therefore seem to be losing hope in a bounce back.

Innes commented: “Bonds are not supposed to trade like meme stocks, which is a primary reason the market is in a constant frenzy. Frankly, I am finding it tough to paint any semblance of a bullish backdrop for the broad market amid this sort of wealth destruction as tighter financial conditions have reduced the global equity.”

Mihir Kapadia, chief executive of Sun Global Investments, said: “The worry now is that a recession is imminent and earnings, which are the denominator in price to earnings (P/E) ratios, may decline quite sharply.”

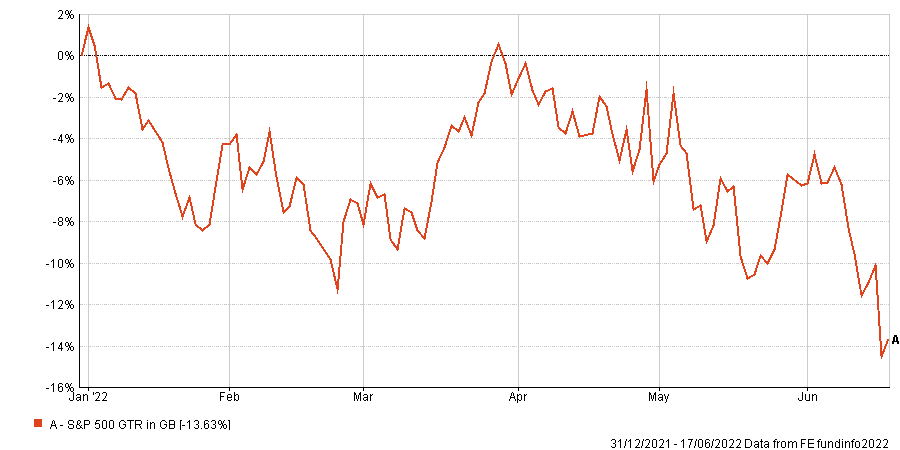

He also noted how consumer goods, lifestyle and travel stocks faced the brunt of the market falls, which has led to the S&P 500 dropping 13.6% year to date, as shown below.

S&P 500 year to date performance

Source: FE Analytics

But, as much as Innes worried about a hard landing, he remained cautiously prudent regarding predictions of a recession, especially if they are based on market indices.

The S&P 500 turned into a “virtual gambling casino” over Covid, paying 18% in the three days after the March market bottom, and it generally kept going up while the economy was in lockdown. This is a reminder that there is no link between the market's daily moves and the real economy, he said.

He also argued that investors should now watch two things: inflation forwards and short-end interest rate spreads. “There is no respite from interest rates. If the market priced the Fed to back off, there would be a light at the end of the tunnel”.