Fundsmith, Baillie Gifford and Blue Whale Growth were among the giant funds that have been downgraded from five crowns in the latest rebalance of the FE fundinfo Crown Ratings amidst challenging macro conditions.

The ratings are a quantitative measure intended to help investors distinguish between funds that are strongly outperforming their benchmark and those that are not. The ratings are rebalanced every six months and measure funds by their alpha, volatility and consistency of performance.

The top 10% of funds are awarded five crowns, the next 15% receive four crowns and each of the remaining three quartiles are given three, two and one crown(s) respectively.

A move from five to four crowns doesn’t mean a fund is struggling, but it is an indication that it has dropped from the elite top-decile percentage of funds within its sector.

In the latest rebalance, which takes into account the last six months of 2021, many of the fund management industry’s big quality-growth stalwarts have been moved from five Crowns to four.

Source: FE fundinfo

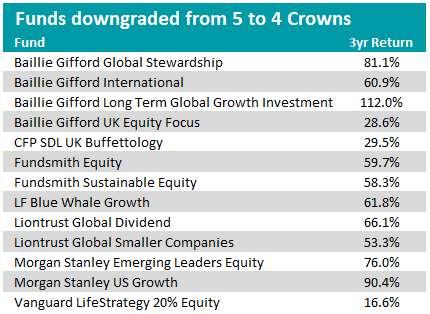

The table above shows some of the most well-known funds that had a rating of five before the rebalance, but have now been downgraded based on their total return for the three years to the end of 2021.

These funds were among the 105 funds that went from five crowns to four crowns in the latest rebalance. One of the most notable was Terry Smith’s Fundsmith Equity.

The £26.2bn buy-and-hold global quality-growth giant has not been spared by the recent volatility in the bond markets.

Long-term bond yields have been rising over the past few months on the back of rising inflation and an anticipation of central banks raising interest rates. This has hurt the valuation of many growth-stocks – whose future earnings are hit harder by a higher discount rate implied by the higher bond yields.

Other global growth-orientated funds such as LF Blue Whale Growth, Baillie Gifford Global Stewardship and Baillie Gifford Long Term Global Growth Investment were among the funds that were downgraded.

However, the damage caused by rising bond yields and the value rotation has not been limited to just the funds in the global sector.

Other large notable funds such as Morgan Stanley US Growth, CFP CDL UK Buffettology and Liontrust Global Smaller Companies were also among those that were downgraded in the rebalance.

Charles Younes, research manager at FE Investments said the main reason for many of the downgrades in these funds was not due to stock selection, but because of the more difficult macro environment.

“These funds have struggled over the past six months,” he said. “They are not bond proxies, but they have a lot of companies that are, which are quite sensitive to change in bond yields, especially in terms of valuation.”

“They don't allocate to anything that is inflation sensitive – which is contrary to a lot of value funds – so it makes sense for them to underperform, something that is reflected in the three-year numbers.”

In the past, the three-year numbers used to assess funds were over a period where growth outperformed for the whole duration, he said, but the latest figures reflect the fourth quarter of 2020, as well as the first and last quarter of 2021 where value outperformed noticeably.

Performance of MSCI World Growth vs MSCI World Value over 14 months

.png)

Source: FE Analytics

Younes said: “Now there has been a good mix between growth and value, so it makes sense them for not to have a five-crown rating, but they’re still very good,” he added.

“It's not driven by their stock picking, and that's why we keep recommending funds like Fundsmith, which has not been changed in our approved list. It's just a market environment moving away from what they like.”

Younes added that the same reasoning applies to the Baillie Gifford funds which were also downgraded to four crowns. Many of the out-and-out growth-focused investment firm’s biggest investments have been hit particularly hard by rising bond yields.

“We still like Baillie Gifford. If they were chasing alpha or starting to do something different and selling some of their companies, we would be very worried, but from a fundamental, bottom-up point of view, the companies they are buying are still growing significantly – its just the pricing of those companies,” he said.

Some other well-known funds that are not shown in the table but were still downgraded by the recent rebalance include Vanguard LifeStrategy 60% Equity which went from four crowns to three, Vanguard LifeStrategy 100% Equity went from three to two and Lindsell Train Global Equity, which went from two to one.

Whilst the Vanguard funds were downgraded due to the more difficult macro environment, in the case of Lindsell Train Global Equity, Younes said there were concerns from a stock picking point of view.

“It was less due to the market environment but there have been a few stock picks that have turned out wrong,” he said.