UK smaller companies funds and strategies focused on recently unloved south-east Asian equities were the strongest performers in August, according to FE fundinfo data, while gold and gilts struggled.

While August is typically seen as a quiet month in markets, this year proved to be a more interesting one with some sizable moves in equities. The MSCI AC World index, for example, made a total return of 3.6% last month, with market leadership reverting back to growth stocks over value.

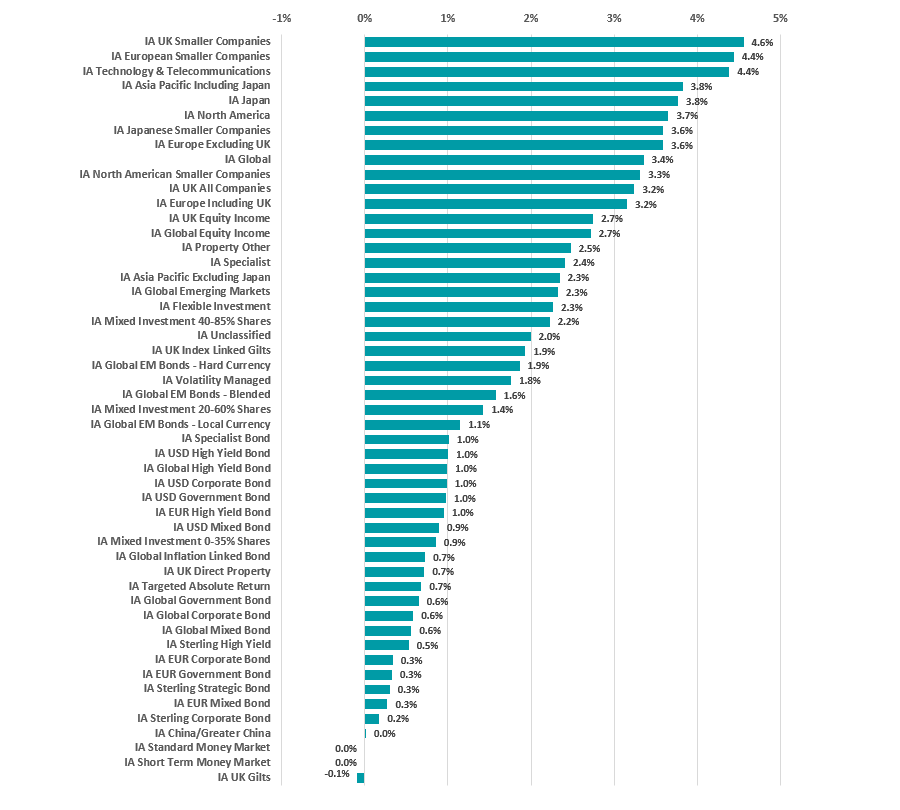

Although the FTSE All Share’s 2.7% return lagged behind peers such as the S&P 500 (4.1%), Topix (4.1%), MSCI Emerging Markets index (3.7%) and Euro STOXX (3.2%), it was the IA UK Smaller Companies sector that posted the month’s highest return.

The average fund in the peer group gained 4.6% over the course of the month, edging ahead of the 4.4% made by both the IA European Smaller Companies and IA Technology & Telecommunications sector.

Performance of Investment Association sectors in August 2021

Source: FinXL

August’s top funds from the sector were L&G UK Smaller Companies Trust (up 7.2%), TB Whitman UK Small Cap Growth (7%) and Jupiter UK Smaller Companies (6.4%).

The IA UK Smaller Companies sector has been the standout performer over 2021, as investors flocked to small-cap stocks amid the optimism of the ‘re-opening trade’ and the UK became more attractive, thanks to a successful Covid vaccine rollout combined with a resolution to Brexit.

Ben Yearsley, investment consultant at Fairview Investing, pointed out that some of this renewed interest in the UK stock market is manifesting itself through takeovers of British businesses.

“For the UK it is now all about takeovers – which company will be next to fall and at what premium to the previous closing share price?” Yearsley said.

“Seemingly nothing is off the table, though it is happening mainly below the FTSE 100 where the action is occurring. Many commentators have been saying there is good value on the UK stock market, and now overseas investors agree and are making bids for all manner of company.”

On a sector level, the UK was also bringing up the bottom of August’s performance rankings as well – the IA UK Gilts sector was the only peer group to post a loss last month as yields rose.

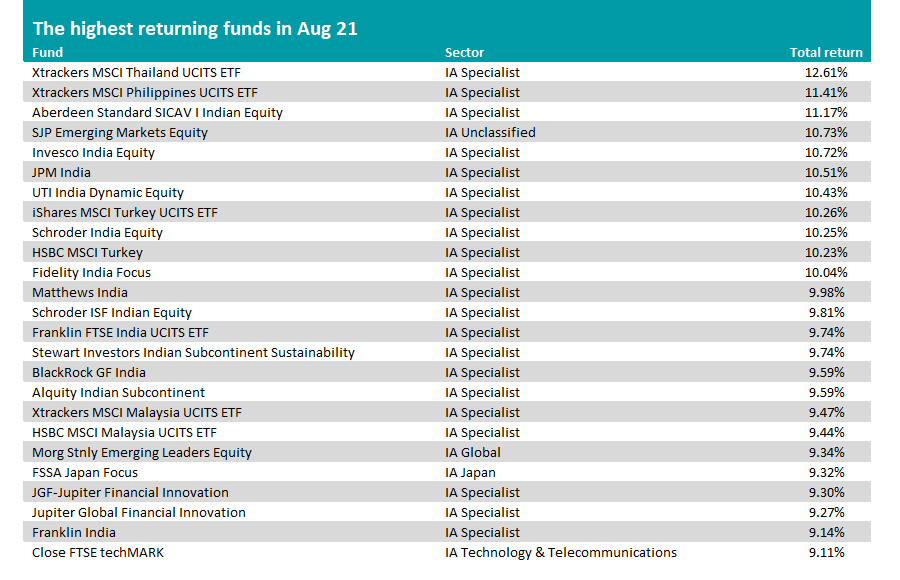

Turning to individual funds, the top of the tables was dominated by south-east Asian equity funds – especially those that focus on India.

Source: FinXL

Xtrackers MSCI Thailand UCITS ETF made the month’s highest return at 12.6% followed by Xtrackers MSCI Philippines UCITS ETF’s 11.4% gain.

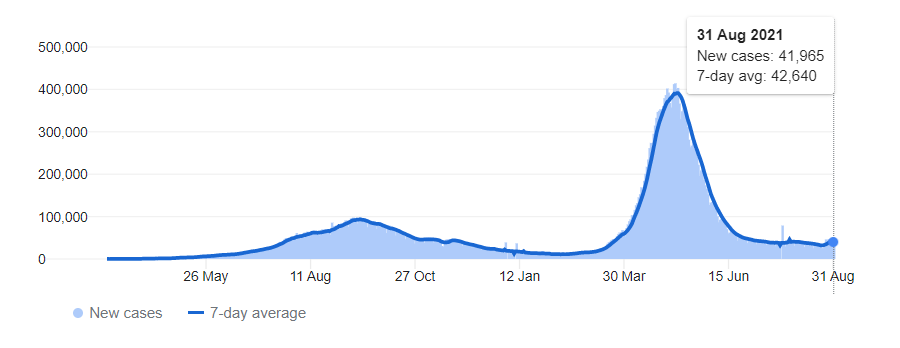

Parts of south-east Asia seems were one of the destinations that investors were avoiding in the recent past because of rising Covid rates and continued restrictions intended to tackle the pandemic.

However, several countries are now seeing new cases decline and have started ease some restrictions, leading to the ‘re-opening trade’.

Thailand and Philippines are relatively niche investments for most investors; India funds are a bit more common and, as the table above shows, these accounted for the majority of August’s best funds.

New cases in India during Covid pandemic

Source: Johns Hopkins University Center for Systems Science and Engineering, Google

India had been one of the countries worst hit by the Delta variant of coronavirus, with daily cases reaching almost 400,000 at the height of its most recent wave. This has now fallen to around the 40,000 mark.

Aberdeen Standard SICAV I Indian Equity, Invesco India Equity, JPM India, UTI India Dynamic Equity, Schroder India Equity and Fidelity India Focus all made a total return of more than 10% last month.

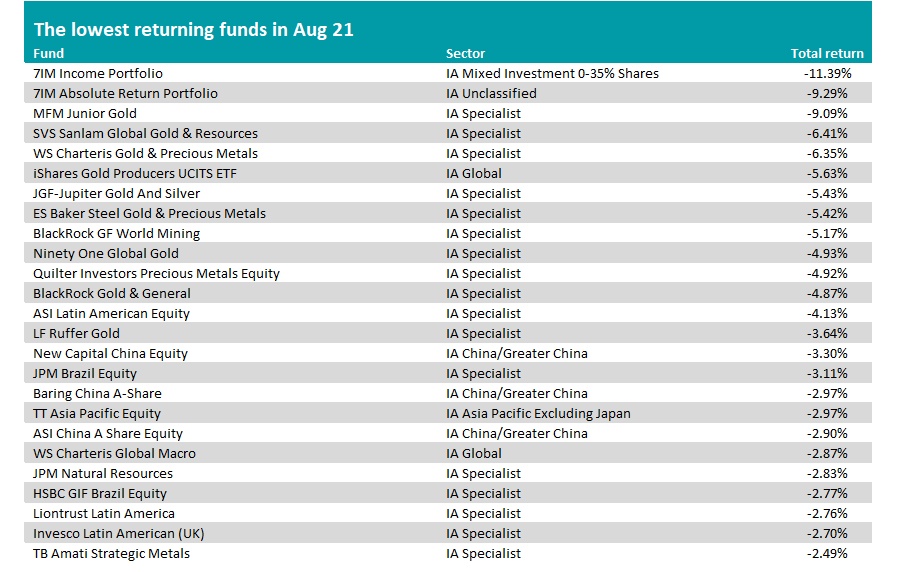

At the very bottom of August’s performance table were 7IM Income Portfolio and 7IM Absolute Return Portfolio. Both of these funds are currently suspended because of “ongoing liquidity challenges”.

Source: FinXL

Aside from those, the biggest losses were posted by gold and precious metals funds. Although gold was up slightly during August, the yellow metal has struggled to make ground in 2021 as investors became more optimistic and turned away from safe havens.

“As the gold price didn’t move in August, there was no real catalyst for the negativity,” Yearsley said. “There was an element of stocks trading ex-dividend (with some very chunky payouts), a slightly stronger dollar and also the pickup in bond yields but, overall, there was no big new to affect gold shares.”