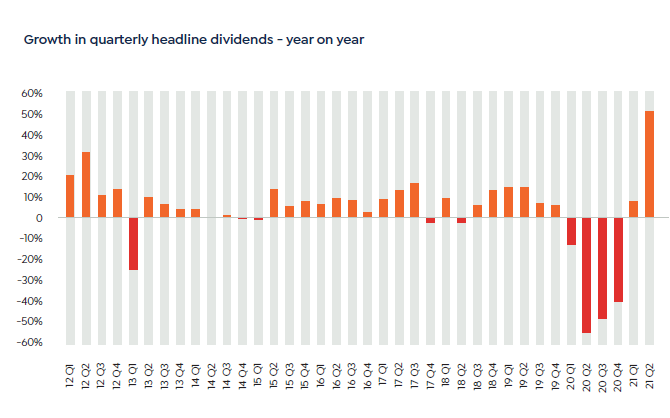

UK dividends saw a “phenomenal” jump in the second quarter of 2021 of more than 50%, exceeding Link Group’s expectations.

The latest Link Group UK Dividend Monitor found that headline dividends rose 51.2% to £25.7bn in total during the three months between April and June and on an underlying basis – excluding special dividends – payouts rose 43.8% to £24.8bn. This was £1.5bn more than Link Group initially forecast.

Source: Link Group

Dividends are still one-sixth lower than they were pre-pandemic but this is still “an impressive recovery,” the Group said.

The biggest contributor to the dividend growth, accounting for 90% of the increase year-on-year, was companies restarting payments after cancelling them to cope with the financial and economic consequences of Covid-19.

The timing of companies resuming their normal dividend payment schedule was another big contributor to the dividend growth last quarter.

A direct year-on-year comparison to 2020’s second quarter showed the extremes the UK dividend market experienced during the pandemic. This time last year market payouts dropped by 57%, a major “low point” for investors, but this did provide an “exceptionally favourable base” for comparison 12 months on.

Ian Stokes, managing director of corporate markets UK and Europe for Link Group said they had been voicing caution over the past year that dividend patterns would be “very noisy as we moved through the recovery phase.”

“This will make for choppy waters in the months ahead,” he added, as the economic and dividend recovery still has some way to run to get back to pre-pandemic levels.

Yet the latest figures provide optimism for investors. Indeed, Link Group scrapped its worst-case forecast as the overall picture was “so encouraging,” focusing on the top end of its expectations.

The group is now forecasting headline dividend growth of 24.4% to a new total of £79.5bn this year – £2.5bn more than April forecast.

Underlying dividends, which exclude specials, are set to rise by 13.4% to £71.2bn, £2.7bn more than the April forecast, while 2025 still remains the target for underlying dividends to fully reach pre-pandemic levels.

In 2021’s second quarter the biggest dividend paying sectors were mining, banking and oil, accounting for two-third of the total dividend increase. Some £8.7bn, was generated by mining and banking alone.

Banks were given the green light to restart its dividends “months ahead of schedule”, Link Group said, which will likely mean bigger banking dividends in the second half of the year than was initially expected.

Meanwhile oil also rose, although not as much as the other sectors. From the third quarter onwards, however, investors will see the year-on-year comparisons for oil reflect its new base, with dividends from the sector anticipated to settle at around £1 in £10 of UK dividends in the future.

These three sectors led the resurgence in top 100 dividend payers, which saw dividends rise by 44%, but further down the cap space mid-caps had the biggest positive rebound.

The FTSE 250 index, which is full of sectors such as hospitality and travel that were forced to hold back cash to survive last year, was “disproportionately impacted by the pandemic,” according to Link Group.

With the reopening of businesses and economies during the first half of this year the bounce-back has been faster for medium-sized firms.

Pay-outs increased by 156% in the second quarter on a headline basis and 139% on an underling basis for the FTSE 250, totalling £2.3bn, excluding special dividends, although this is still a “long way short” of the £4.1bn in the second quarter of 2019, Link Group added.

Overall, Link Group said they were “optimistic on the outlook of 2021,” even though some of the easy wins for income and dividends had now passed.

It upgraded the forecast to account for more banking dividends, but cautioned that there was “a lot of uncertainty” around exactly how much capital banks would return to shareholders.