Chinese equities gained significant attention in 2020 after emerging from the Covid-19 outbreak first and making strong returns in a year where other markets plummeted. However, there were several reasons for the outperformance of Chinese strategies, according to the new manager of the Matthews China Small Companies fund.

And the $317m Matthews China Small Companies fund was its best performer with a total return of 72.22 per cent.

Performance of fund vs sector and benchmark in 2020

Source: FE Analytics

Its new manager, Winnie Chwang, took over the fund late last year following the departure of Tiffany Hsaio.

According to Chwang there are several reasons why Chinese equity strategies outperformed in 2020.

One was because its ability to contain the coronavirus.

Having been the first to succumb to Covid-19, with cases clustered around the city of Wuhan, China was the first to enact stringent lockdown measures and first to emerge from them.

And as it emerged, the Chinese economy was the first to open up.

The manager said: “In terms of the success of the virus containment, that was very incredibly successful and leading to growth in 2020 and what we believe [to be] a very resilient, continued recovery for 2021.”

However, even before the pandemic accelerated China had entered 2020 with a focus on corporate growth, according to the manager.

“Now a lot of that was just derailed for the bulk of 2020,” Chwang said. “But we did see that recovery and the progress being made, even from a quarterly basis.”

The first quarter was when the lion’s share of the Covid-19 impact was felt on companies, according to the Matthews Asia manager, but some firms started reporting a recovery in Q2.

“In the fourth quarter, we [were] seeing signs of normalcy in some sectors,” the manager said.

This isn’t to say that every sector has fully recovered, however.

As with other countries, the services sector is still one of the most badly hit and in China “is still on the edge of just trying to get back to normality”.

She added: “But on the whole, I would say that recovery is on track and in progress.”

Looking at the smaller companies space, the different make-up of that sector compared with the large-caps contributed to its outperformance.

According to Chwang (pictured), China’s small-cap space has a high tech and healthcare exposure of about 20-30 per cent combined.

“If you compare that to [the] all-cap space – which the benchmark of representation there is MSCI China – it has only about 10 per cent in IT and healthcare,” she explained.

“So, this universe is predisposed and much more prominent in IT and healthcare, which are certainly fast-growing, knowledge-based sectors that China has been trying to pivot to.

“And [it] has been quite successful in pivoting into over the last couple of decades.”

As such, the Matthews China Small Companies fund benefited from the strong performance of the technology sector.

Technology in China also benefitted from the trade war with the US, according to Chwang, as it’s pushed China to become more self-sufficient and build more innovative technology.

“We’re by no means saying that none of these Chinese tech companies can eclipse the success of its western peers,” she said, “but it’s a really nice start because it’s an unprecedented opportunity to scale up very meaningfully.”

Chwang added: “There’s been a lot of embrace in terms of using local whenever possible.”

On healthcare, the manager noted that the fund was still somewhat neutral on the sector as valuations remain high and new drug pricing rules are debated.

Despite that, there has been a considerable amount of research and development going on as China pushes to become more self-sufficient, producing more innovative drugs and pivoting away from generic approaches, she added.

Chwang took over management of the Matthews China Small Companies fund in August last year with co-manager Andrew Mattock. The pair also run the $152.1m Matthews China fund.

Managing this other strategy meant that the team already had an understanding of the types of companies and opportunities available in the small-cap space, according to Chwang.

“There’s a lot of commonality in terms of mindset as to what companies that we like,” she explained.

“What we do from a process standpoint, [and] which is similar, is we do look for the best of breed.

“For us it’s important, particularly in the China small company space, to be quite familiar with what’s out there, [the] whole universe if you will, and try to kick out 99 per cent [of companies].

“We’re only really interested in that top 1 per cent of the universe, as potential opportunities for the strategy.”

The fund holds between 40 and 60 names with the average holding position ranges from 1 per cent to 5 per cent, with a cap at 5 per cent.

But there is one change from the previous manager’s process, according to Chwang, utilising a ‘growth at a reasonable price’ approach to stockpicking.

“If there’s any difference to Tiffany, maybe [we’re] a bit more sensitive to valuations than perhaps the previous team,” she said.

“But that’s really just based off of our personal careers and our training.”

Looking ahead to 2021, Chwang said she was “cautiously optimistic” about the prospects for markets based on China’s ability to contain Covid-19.

“There’s still signs of resurgence that have been popping up here and there, especially in the first couple of weeks of January,” she said.

“So, we’re monitoring valuations, but we do feel that there is just a greater sense of preparation and being prepared.”

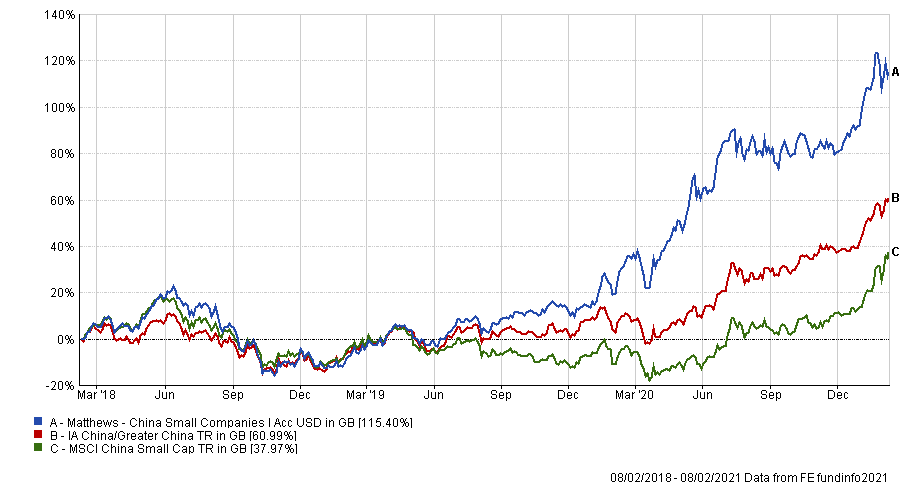

Over the past three years, Matthews China Small Companies has made a total return of 115.40 per cent, beating the IA China/Greater China sector (60.99 per cent) and the MSCI China Small Cap benchmark (37.97 per cent).

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

With an FE fundinfo Crown rating of five the fund has an ongoing charges figure (OCF) of 1.25 per cent.