As the markets are bracing for the possibility of a global recession, investors have been wondering how to diversify their portfolio in search for assets that won’t fall as the market turns into bear territory.

Gold has traditionally been a safe haven and has worked as a diversifier for a long time. In fact, head of commodities and macroeconomic research at WisdomTree Nitesh Shah showed that owning up to 12% in gold alongside a traditional 60/40 portfolio would have provided maximum diversification from 1973 to today.

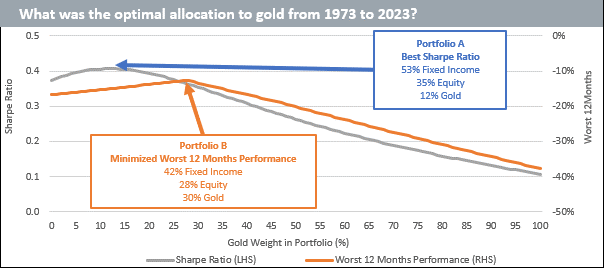

The grey line in the chart below illustrates the Sharpe ratio (which measures the return of a portfolio relative to its risk) of a 60/40 portfolio for every incremental percentage of gold added to it. The curve peaks at 12% of gold weight, which is where the maximum benefit is reached.

A second line (orange) measures the maximum drawdown (the worst expected performance in a 12-month period). Here the maximum drawdown was at its lowest when the gold allocation reached 30%.

Source: WisdomTree, Bloomberg.

“By adding gold to a traditional portfolio of stocks and bonds, it’s easy to see that the Sharpe ratio can be improved,” said Shah.

“An illustrative portfolio of 60% bonds and 40% equities with no gold allocation has a Sharpe ratio of 0.37, but as we increase the allocation to gold and keep the rest of the example portfolio weights in a 60/40 bond-equity allocation, the Sharpe ratio starts to rise, peaking at 0.41 with 12% gold.

“Gold can be volatile asset and detracts from the Sharpe ratio after a certain point. This is a lot more than what we believe most investors currently allocate to gold.”

But 12% isn’t feasible or agreeable for everyone. David Coombs, fund manager of Rathbone’s multi-asset portfolios, for example, does not believe in optimisation for setting his investment strategy.

“It is something I tried and abandoned over 15 years ago as it is too reliant on past data. Even forecasts claiming to be forward looking tend to suffer from ‘anchoring’,” he said.

“I see gold as a tactical tool rather than strategic. Valuing the metal can be an art rather than a science. But it is still regarded as an asset of real value in use by central banks, which brings some comfort that it will continue to store wealth.”

There are two scenarios where gold could be attractive, said the manager.

“The most obvious is stagflation but you need this to be a concern across most developed markets, and in particular the US, for the price to benefit. It is not much of a hedge if it is just the UK you are concerned about. The fact it is traded in US dollars will help, but it’s the dollar that’s working, not gold, and you’d still be better off in US Treasuries and cutting the coupon,” he said.

“The second scenario is a weak US dollar. During these periods it is best for a sterling investor to buy gold and hedge the dollar. In any other time, gold is an inefficient store of capital.”

Darius McDermott, managing director of Chelsea Financial Services, is self-admittedly usually pro gold, but at the moment wouldn't be adding to it.

“It traditionally does well when central banks are printing money and they are doing the opposite at the moment. It's also not a yielding asset and when you can get 5% on cash or similar rates on government bonds, to me it has less of a role to play,” he said.

“Can you get 5% risk-free holding gold today? No. We currently have about 3-4% in our managed funds – really as hedge against central banks getting things wrong. We'd decrease this and add to other areas, if opportunities arose.”