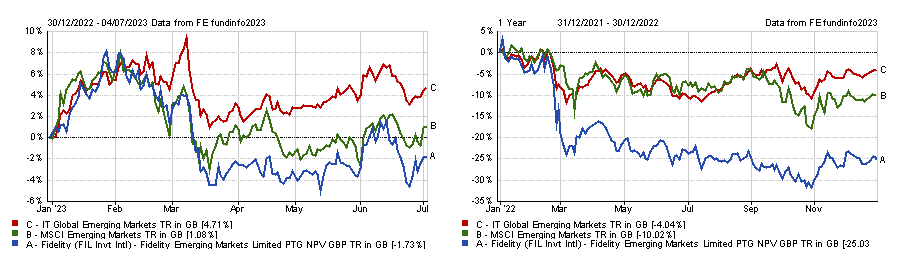

Investors that backed Fidelity’s takeover of the Fidelity Emerging Markets trust in 2021 may well feel disappointed, with the fund down 30.8% under the firm’s stewardship while the rest of the IT Emerging Markets sector made a modest return of 1.1%.

Yet there are reasons for optimism as the £539m portfolio – previously called Genesis Emerging Markets – adopts the same strategy used in the open-ended Fidelity FAST Emerging Markets fund, which beat the Equity Emerging markets sector with a total return of 57.6% over the past decade.

Chris Tennant, manager of the Fidelity Emerging Markets trust, acknowledges performance has been below par, but tells Trustnet that investors can make the most of volatility in developing economies by investing in the winners and shorting losers.

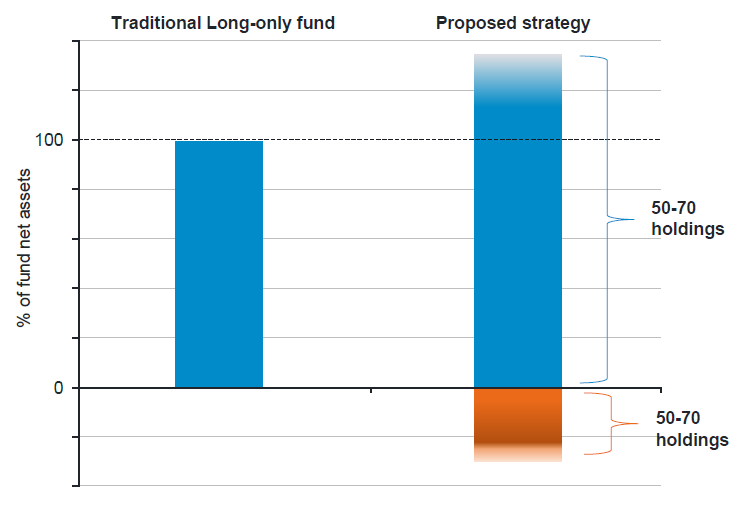

Total return of trust under Fidelity’s management

Source: FE Analytics

What is your investment approach?

The core focus of the strategy is around quality, which we define as businesses that are able to generate excess returns relative to their industries and the wider market.

A lot of our job is trying to understand why a business is able to generate those excess returns and how sustainable those returns are.

The FAST Emerging Markets fund has the same strategy as this trust and that strategy has been going since 2011. It’s run by Nick Price who is a portfolio manager on the trust as well.

How does this trust differ from its peers?

A traditional fund might have 100 assets and all of those will be invested in a long-only portfolio of equities. We extend that long book – typically towards 130 – and also add 30% in short positions.

That part of the portfolio includes a wide range of businesses that we see as structural losers, so for every pound you have invested in the trust, there'll be around £1.60 working for you. That ability to extend the long book and add the short book is one of the ways we add value.

We’ll identify what we see as the structural loser in an industry and we'll have a short position in that paired against a long position in the winner. There are other more stock specific, idiosyncratic short holdings where we’ve found accounting or corporate governance abuses.

Long and short book of traditional trust vs Fidelity Emerging Markets

Source: Fidelity International

Are you finding more shorting opportunities in emerging markets than you did in developed countries?

Definitely – there's so much more corporate governance abuse in emerging markets compared to developed markets. There are also more related party transactions where the controlling shareholder in a business might own a related party that does all the construction for the company, for example.

That sort of thing is much more prevalent and is why active management is so incredibly important in emerging markets. It does throw up a lot of opportunities for the short book.

In times of higher volatility, that’s where the short book adds more value. Although I think interest rates will start to come down, I think we're in a structurally higher interest rate environment and a lot of our short companies have excessive levels of debt.

These types of over-levered companies were able to survive in a zombie-like state when rates were at zero, but the cost of paying off that debt today leaves them even more vulnerable, so it's been a particularly good year for shorting. It’s added about 200 basis points to performance this year.

The trust has made a loss since you took over – do you see that improving?

Last year was challenging because of the exposure we had to Russia. We had a number of Russian investments that were incredibly high-quality assets (largely in the commodity space), at extremely attractive valuations and they were returning enormous amounts of cash returns to shareholders.

Those were our reasons for being invested but, in hindsight, it was obviously a mistake given what transpired with the war in the Ukraine. We’re now unable to trade those positions so we still have ownership of those stocks.

Oil producing countries like Saudi Arabia did extremely well from higher energy prices, but we didn't have exposure to them. That was a big drag on performance but thankfully, performances has stabilised from October to April and we’re back in positive territory, so hopefully that can continue.

Total return of trust vs sector and benchmark in 2022 and 2023

Source: FE Analytics

What are you most excited about in emerging markets?

The direction of monetary policy is one of the core reasons to be invested in in the asset class. We're approaching the last innings of rate hikes and for many central banks across the world, the next move is to start cutting interest rates.

What you've seen in emerging markets is central banks being well ahead of the curve, much more so than some developed markets such as the UK. As you see those banks start to cut rates, that's going to be a big tailwind for the emerging market consumer.

There’s also the fiscal backdrop of these countries. During Covid, countries around the world handed out huge amounts of subsidies to their population but that wasn't the case so much in emerging markets.

They were extremely disciplined when it came to the fiscal environment and the fiscal attractiveness of emerging markets compared to developed markets is the best it's ever been.

What has been your best performing stock?

The top contributor during our time managing the trust has been Brazilian rental car company Localiza Rent a Car, which has added just over 100bps to performance over this period.

The company has done well after merging with a key competitor, Unidas, which enabled it to grow its market share from 25% to 42%, consolidating its competitive position relative to other smaller players in what is a very fragmented market.

Although higher interest rates are usually a headwind for rental car companies, Localiza has been able to grow its fleet regardless. The stock has done particularly well year to date due to the expectation that Brazil will cut interest rates this year.

What was your worst performer?

Top detractors from relative returns during our time managing the investment company have been Russian stocks. We went into the war with an overweight exposure to Russia.

The stocks owned by the investment company were fair valued to zero, given the lack of price discovery and the inability of foreigners to trade the market.

What are your interests outside of work?

I love to travel, which was one of the things that attracted me to emerging markets when I joined Fidelity in back in 2010.

I am a keen cyclist and enjoy spectating all sports and, as a Londoner, I regularly attend Arsenal games.