Commodities were among the best-performing asset classes of 2022 but experts are mixed on whether the good times will continue.

Last year the IA Commodities/Natural Resources sector rose 18% and is up 40% since January 2020, yet while some think the rally has room to grow, others are more cautious about jumping in.

Below, Michel Wiskirski, manager of the Carmignac Climate Transition fund and Rob Crayfourd, investment manager at New City, discuss the advantages of oil and copper, while Blake Hutchins, manager of Trojan Income, remains sceptical.

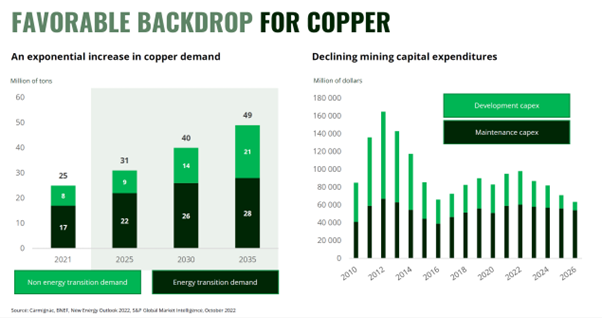

One reason why both commodities look attractive according to Wiskirski is a growing demand paired with little capital expenditure and supply constraints.

“On the one hand, copper is needed for the energy transition to produce renewable energy and manufacture electric vehicles. By 2035, renewables are estimated to require almost double the amount of copper they use up now,” he said.

“On the other hand, increasing demand will not be met by an increasing supply, which will also drive prices. There aren’t many sites where to extract copper from, and the quality of the active mines is low.”

In December, Ero Copper, a Canadian copper ores company, was among the top performers in the Carmignac Climate Transition portfolio.

Projections of copper demand and mining capital expenditure

Source: Carmignac

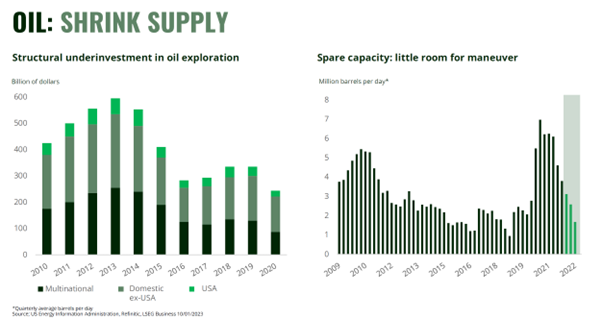

A similar dynamic applies to oil, for which Wiskirski predicted supply difficulties given the diminishing investments and reserves capacity, which will be especially at risk should tensions emerge in Saudi Arabia, for example with Iran.

But there are shorter-term factors that will drive prices, too.

“In China, Xi Jinping’s zero-Covid policy has put a brake on consumption for three years, during which the Chinese demand for oil halved. Now, as the country reopened, we are expecting it to reach much higher levels,” said the climate transition manager.

About 6.1% of Wiskirski’s portfolio is invested in oil companies “that have adopted drastic policies to shrink their carbon footprint and are expanding their commitment into renewables”.

This includes Valeura, GeoPark and Repsol, which were among the stocks mentioned in the fund’s factsheet for having made a positive contribution to returns in December 2022.

Investments in oil and reserves capacity

Source: Carmignac

In a recent article written for Trustnet, Crayfourd shared Wiskirski’s worries that the supply of global commodities looks “wholly underprepared” for even moderate demand growth.

“In oil markets, OPEC [the Organization of the Petroleum Exporting Countries] has limited spare capacity and the quicker response shale producers simply aren’t ramping-up activity significantly. In copper, we are barely seeing enough investment to maintain production, never mind meet the large deficit expected over the next decade,” he said.

For this, he blamed environmental, social and governance (ESG) policies that have focused on emissions reduction rather than production growth (in doing so, they have “broken the supply response function” which may sustain higher prices for longer than expected), while an uncertain regulatory backdrop may also discourage investment.

Against this backdrop, oil and gas producers look attractive on both a top-down and bottom-up view, according to Crayfourd, and they also trade at low historic earnings multiples.

To help reduce possible volatility, he suggested pursuing a basket approach to include some precious and base metals exposure.

Not all agreed, however, and Hutchins is one of those taking the opposite view.

“Oil and gas is having its day in the sun primarily because when there is high inflation the textbook tells you to hedge that with commodities. Secondly, oil and gas companies are not investing huge amounts in additional capex at the moment, and as they're keeping their capital discipline and therefore generating cashflows, they are attractive to investors in this moment in time,” he said.

But there is a problem with this that is linked with the fundamentals of the oil and gas business model, which make the sector an exclusion in Hutchins’ fund.

“You never know when the cashflows are going to turn volatile because they are just a function of the oil price, which the companies cannot control. This makes it a naturally capital-hungry business model, with a very low return on capital,” he said.

“Oil fields deplete on average 5% to 6% a year and in order to replace that lost oil, companies have to drill for more. As their reserves deplete, they can only ‘not invest’ for a certain amount of time, otherwise, the business goes to zero.”