Investing is a game of discipline, not only for investors but also for companies. At a time when credit costs a lot more and investors unwilling to part with cash due to upcoming worries of a recession, smaller companies might seem riskier investments than their larger counterparts, which tend to have more cash and better balance sheets – the perfect safety nets to fall back on.

While some smaller companies have been hit hard by the pandemic and the new high-rates environment, others have managed to hold onto cash and bolster their balance sheets for the challenges ahead, said John Moore, senior investment manager at RBC Brewin Dolphin.

“This is particularly true of companies in sectors facing structural change – for instance, retail and leisure,” he said adding that “businesses which have maintained financial discipline could prove to be the big winners in their respective industries as competitors struggle in an increasingly difficult trading environment”.

Below, the investment manager highlights five smaller UK companies that are in a better position than others to weather a recession.

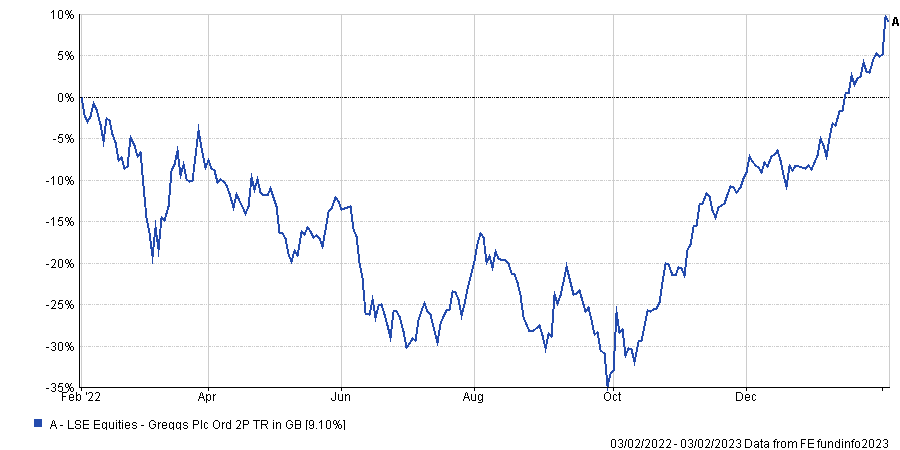

First up is Greggs, which had a tumultuous 2022, nearly halving its value before getting back on a roll in recent months, up 67.5% since its bottom in October.

Performance of stock over 1yr

Source: FE Analytics

“The FTSE 250 baker recently demonstrated its resilience by reporting a rise in sales of 23% in its financial year up to December 31 compared to the same period the year before,” said Moore.

“The threats of rising energy prices, the increasing costs of ingredients, higher wages, and an uncertain retail environment, which originally sent Greggs’ share price into a tailspin, persist but the company has shown it can take the necessary steps to sidestep them.”

A good innovator during tough times, a healthy cash balance will likely be required to mitigate any potential issues. Currently the firm has £191m held back in reserve.

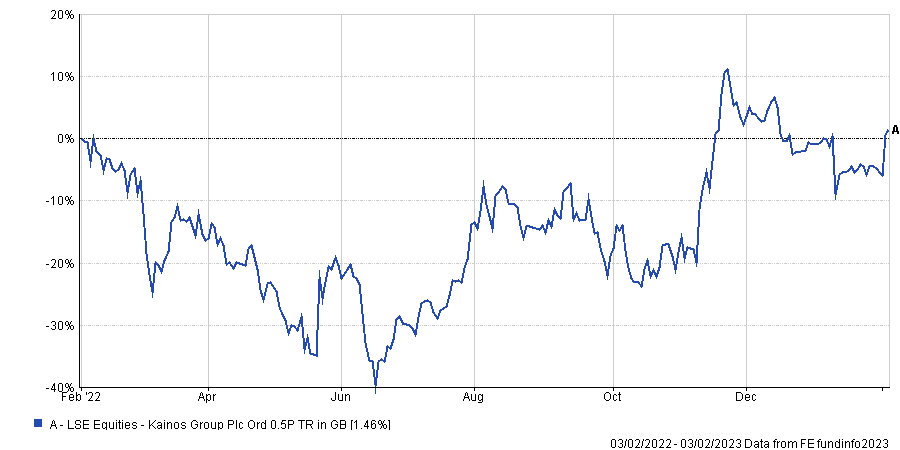

In Northern Ireland, Moore looks favourably at Kainos, a global digital services and product provider that is benefiting from “long-term industry tailwinds” and can “accelerate new business opportunities that will come from tougher economic conditions”.

Performance of stock over 1yr

Source: FE Analytics

In particular, the investment manager is expecting a further push into the North American and European markets, which will require capital. Thankfully, the stock has £97m of net cash for the occasion.

“The company is a beneficiary of businesses and public sector bodies looking for efficiency, whether that is through technology-driven improvements, outsourcing HR processing, or the need to implement change,” he said.

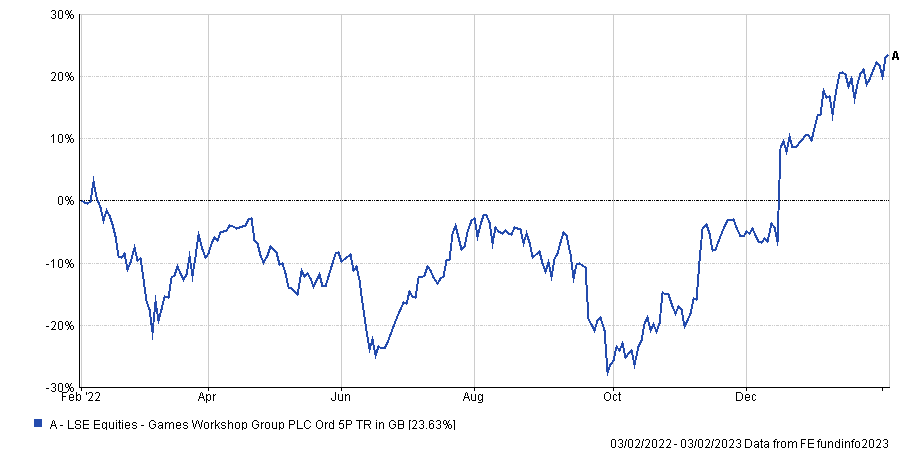

Owner of the Warhammer fantasy figurine game, Games Workshop was also on Moore’s virtuous companies list.

“The company has been a long-time City favourite, leading to questions over whether it could continue to deliver. However, it has managed to pleasantly surprise over and over again, and currently sits on a cash pile of around £71m according to its latest annual report.”

Performance of stock over 1yr

Source: FE Analytics

Lately, it has branched out into media through video games and a recent agreement with Amazon to develop a TV series based on its games.

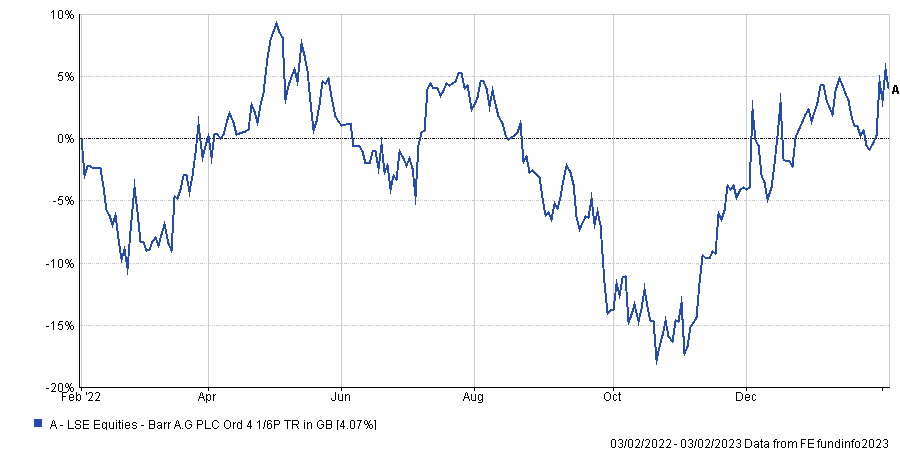

Another FTSE 250 favourite is Irn-Bru maker AG Barr, which has always been a cautiously managed company supported by a strong balance sheet, according the Brewin Dolphin manager.

“Despite the challenges of the past few years, particularly two years of lockdowns, it has navigated its way through and found itself with a cash position of more than £61m,” he said.

“The company has flexed its financial muscles recently with the acquisition of Boost Drinks for £20m and taking full ownership of Moma Foods, the oat milk and porridge maker in which it already held a stake.”

Performance of stock over 1yr

Source: FE Analytics

Additional moves could be on the horizon as weaker peers struggle in the months ahead, continued Moore.

Lastly, Hollywood Bowl’s 28% increase in revenue growth and a spike in the share price during early December 2022 couldn’t go unnoticed.

Performance of stock over 1yr

Source: FE Analytics

“The company’s last set of results knocked over just about everyone in the City, also revealing some smart moves, including the fact that it had hedged its energy costs out till the end of its financial year in 2024, investment in solar panels, and incremental price increases,” said Moore.

“Add to this a cash pile of just over £56m and there could be some big moves ahead for Hollywood Bowl, particularly with many smaller operators in its market unlikely to be in the same position.”