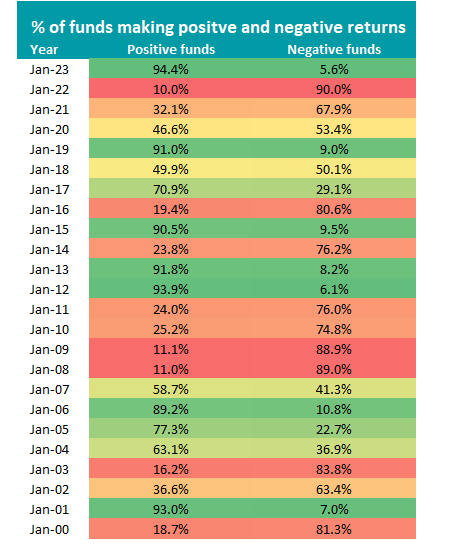

Close to 95% of funds made money for investors in January – a stark turnaround from 12 months ago – but this doesn’t necessarily means it’s all plain sailing from here, portfolio managers have warned.

Last year was one for investors to forget, with most funds in the Investment Association universe racking up losses as markets sold off on runaway inflation and interest rate hikes. The year started off badly, with FE fundinfo data showing that 90% of funds fell in January – a trend that persisted throughout 2022.

However, things look much different at the start of 2023 as investors anchor onto signs that inflation has peaked and central banks will slow the pace of rate hikes. Trustnet’s analysis shows the situation has completely reversed from 12 months ago with 94.4% of Investment Association funds posting a positive return in January and only 5.6% losing money.

As the table below shows, last month was the best January for positive-returning funds since at least the turn of the millennium. These figures include funds that have closed or merged in the intervening years, to reduce survivorship bias.

Source: FinXL

Positive returns look to be across the board. Sectors where every single fund was up in January include IA UK All Companies, IA UK Equity Income, IA China/Greater China, IA Technology and Technology Innovations and IA Japan.

Some 96% of IA Global funds made positive returns last month, as did 98% of the IA Global Emerging Markets. IA UK Smaller Companies, IA Sterling Strategic Bond, IA Europe Excluding UK and IA Flexible Investment are other examples of sectors where more than 90% of funds were up during the month.

The worst performer, on the other hand, was the IA India/Indian Subcontinent sector, where every fund made a loss. Two-thirds of IA Healthcare funds were down and 56% of IA USD Government Bond funds fell as well.

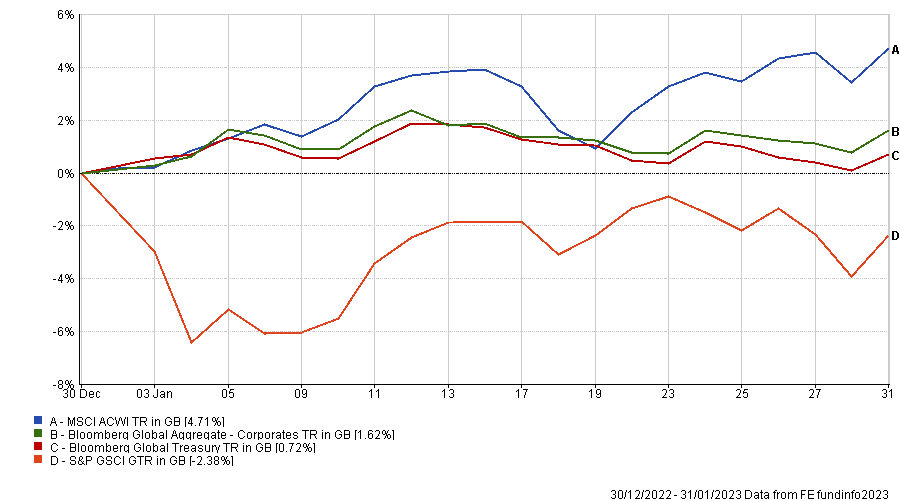

Despite these outliers January was a strong month for funds – reflecting the jump in markets that got 2023 off to a solid start. The chart below shows how commodities have dipped but stocks, government bonds and corporate bonds all rose last month.

Performance of asset classes in Jan 2023

Source: FE Analytics

Ryan Hughes, head of investment partnerships at AJ Bell, pointed to the renewed confidence among investors as the reason for 2023’s bounce.

“Last year was one of huge uncertainty with the war in Ukraine, surging energy prices and central banks scrabbling to try and tame inflation, which left investors unsure as to what was likely to happen next. As we have moved into 2023, while the picture remains somewhat subdued, the level of uncertainty has dissipated which has given investors confidence to invest again, especially as many of the negative events have been firmly priced into markets,” he said.

“During the last quarter, tentative signs emerged that showed inflation may have peaked which in turn means that interest rates may not need to go up as much as previously feared. This has provided a boost to both equity and fixed interest assets at the start of this year with bonds now offering attractive returns after years of low interest rates and equity valuations back at more sensible levels.”

Within his portfolios, Hughes has been increasing exposure to fixed interest and reducing exposure to equities, arguing that the much higher yields in investment grade corporate bonds look appealing while high yield is offering close to equity-like returns.

He added that Asia and emerging markets look attractive on a long-term basis versus developed markets, thanks to China’s reopening and favourable demographics.

That said, Downing investment analyst Alex Paget cautioned against taking January’s strong showing as a sign that the issues which plagued 2022 have been resolved.

“With the benefit of hindsight, it seems inevitable markets would rebound strongly so far this year given the chaos that ensued last year. The strength of this rally has been a welcome relief to investors who seemingly (thanks largely to holding incredibly expensive bonds and limiting equity exposure to high-growth companies) had very few places to hide,” he explained.

“While this is by no means a prediction, we would not be surprised to see a higher degree of volatility over the shorter term. Though we are happy to be wrong on this, it appears that investors are clinging onto anything that resembles good news when, in reality, few of those sizeable headwinds that rocked both equity and bond markets last year have gone for good.”

Downing’s multi-manager portfolios avoid making top-down calls and focus on finding “exceptional active equity managers”, although Paget added that he wouldn’t be surprised if more value-orientated holdings such as LF Havelock Global Select or SVS Kennox Strategic Value outperformed growth funds. They have also added to defensive holdings such as gilts in recent months, while maintaining a “healthy exposure” to cash.

Steve Russell, investment director at Ruffer, warned that January’s rally suggests “investors are trying to have their cake and eat it” as the market is predicting that recession can be avoided, inflation has been tamed and central banks will soon have room to cut interest rates.

“This looks like a case of cognitive dissonance – believing several conflicting ideas at the same time. The stronger the economy, the stickier inflation is likely to be and the less likely the Fed is to cut rates. But stock markets are now assuming an almost impossible trinity of events: better growth and no recession, rapidly falling inflation, and interest rate cuts by the end of the year,” he finished.

“Despite their strong start, markets are not out of the woods yet. Enjoy the early 2023 bounce, but the need for protection in portfolios has not disappeared. Remember that markets can be very wrong. Just a year ago they forecast only 80 basis points of rate rises in 2022 – we ended up with 400 basis points.”