A FTSE 100 tracker, a fund specialising in quality stocks and a well-known value trust are some of the ways that investors can take exposure to the world’s most attractively valued market, Bestinvest’s Jason Hollands says.

Markets across the globe have fallen during 2022, leaving equity valuations at a deep discount to their long-term averages. While it is impossible to predict when markets have reached their lowest point, Bestinvest managing director Hollands noted that sharp market falls often represent a “great buying opportunity” for investors with a long enough time horizon.

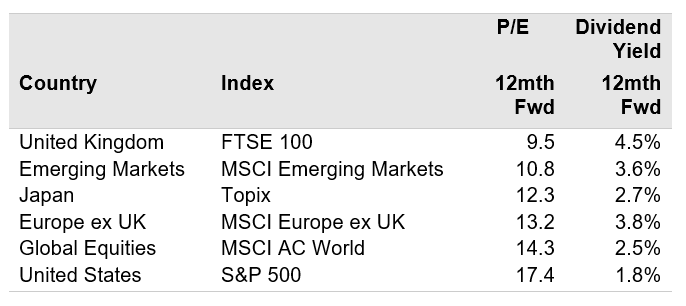

Citing the table below, which shows the projected price/earnings multiples of the major markets, Hollands said: “The greatest value opportunities to be had currently are available close to home with the FTSE 100 trading on 9.5 times earnings. This is a 34% discount to the rest of the world (as represented by the MSCI All Countries World Index) and also far below the longer-term of just over 12 times earnings – so represents something of a steal.

IBES consensus P/E and 12-month forward dividend yield forecasts

Source: Bestinvest, IBES, MSCI, Datastream

“The FTSE 100 is not only cheap, it also offers the highest forward dividend yield among the major regions at 4.5%. This is not only high compared to other markets, it also represents a healthy premium to UK government bonds, with 10-year gilts having sunk back to 2.97% currently after peaking at 4.51% in the aftermath of former chancellor Kwasi Kwarteng’s infamous ‘mini-Budget’. That provides a good degree of support for FTSE 100 stocks.”

He noted a number of other attractive elements of the FTSE 100 such as the fact that three-quarters of the earnings of its constituent companies are made outside the UK, the weighting of defensive sectors such as consumer staples and healthcare that typically hold up well in tougher economic times, and the 14.6% exposure to energy, the best performing equity sector globally in 2022.

For taking exposure to this market, Hollands highlights an index tracker, an open-ended fund and an investment trust that he thinks are worth considering.

He said that a low-cost index fund such as iShares Core FTSE 100 UCITS ETF is a “simple option” for tracking UK blue-chips. With an annual cost of just 0.07%, the ETF mirrors the FTSE 100 index and therefore has a significant weighting to stocks in the consumer staples, financials and energy sectors.

According to FE Analytics, the ETF is ranked 16th out of 254 funds in the IA UK All Companies sector (returning 4.8% versus the peer group’s 8% loss) in 2022. It is also top quartile over three and five years.

Performance of funds vs sectors over 2022

Source: FE Analytics

For those seeking active exposure to the UK, Hollands pointed to Simon Brazier and Anna Farmbrough’s £1bn Ninety One UK Alpha fund, which follows a quality investing approach. The fund’s 4.7% fall this year puts it in the IA UK All Companies sector’s second quartile and it is third quartile over three and five years.

Analysts at Square Mile Investment Consulting & Research, which give the fund an ‘A’ rating, said: “We would highlight that this is not a fund that aims to shoot the lights out on a performance level, instead it looks to outperform regardless of the market backdrop.

“This means that, unlike the more aggressive strategies within the UK All Companies sector, whose more stringent investment styles may cyclically fall in or out of favour, the managers are aiming instead to produce regular and attractive levels of outperformance.

“In recent years, the managers of this fund have been particularly cautious about the state of markets and the macroeconomic backdrop, and so have positioned the fund accordingly in defensive, large-cap companies, which for the most part has hindered the fund's relative returns.”

However, they added that they believe Ninety One UK Alpha remains “a solid proposition” and should offer investors a reliable return profile over the long term.

Hollands’ final UK pick is Ian Lance and Nick Purves’ £736m Temple Bar Investment Trust. The trust follows the value investing approach – looking for good businesses that look underpriced – which was out of favour for much of the past decade but outperformed in 2022’s inflationary conditions.

Accordingly, the trust has underperformed over the past three, five and 10 years (for most of which it was run by a different management team) but has made 7.3% over 2022 so far – the second highest return of the 22 trusts in the IT UK Equity Income sector.

Hollands also noted that Temple Bar’s biggest weighting is to energy stocks, including BP and Shell, its two largest individual positions, which are benefitting from higher oil & gas prices.