There are very few bargains to be found among European focused investment trusts, with only one moving to a wider discount than its five-year average.

The European market has been a strong performer over the long term, with the MSCI Europe index generating returns of 147.9% over 10-years, outflanking the FTSE 100 (92.7%). The only developed market to beat it was the US’ S&P 500 (347.4%).

But this year the market has struggled, underperforming both the UK and US indices, with a total return of 15.8% versus 15.9% and 28.4%, respectively.

After a poorer run, investors may expect to pick up some cheaper bargains, but looking at the IT Europe and IT European Smaller Companies sectors there are very few trusts on a bigger discount than usual.

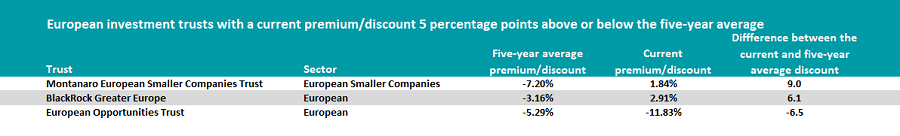

In this series, Trustnet looks at which investment trusts had diverged at least 5 percentage points off their five-year average premium/discount, having already looked at the UK, Global, North American and Japanese sectors.

Buying trusts on a bigger discount can be a profitable way to make money over the long-term whereas those on a larger premium risk reverting back to the median if the trust’s returns cannot maintain pace with investors’ enthusiasm.

However the discount or premium on a trust is not the full story and focusing on just that can be misleading. If a trust is always on a big discount, or a large premium, then it may not offer value or be too expensive.

As such, Trustnet asked QuotedData to look at the current discount and premiums of trusts in the IT Europe and IT European Smaller Companies sectors versus their own history.

Source: QuotedData

Out of both sectors there was only one trust running at a bigger discount than usual: the European Opportunities Trust. It is currently on an 11.8% discount, which is 6.5 percentage points off its average 5.3% discount over the past five years.

One catalyst for this widening discount was Wirecard’s fraud scandal which peaked in 2019 and led to the company becoming insolvent. During this time the company was the largest holding in the trust.

Kepler analysts said that since the event, the trust has been trading on a wider discount then the peer group average.

Another driver of this widening discount is its long-term underperformance, having ranked second-worst over five years in the IT Europe sector (62.1%) and third-worst over 10 years (277.1%).

But Kepler analysts were not overly disheartened by the run of underperformance, commenting that they were encouraged by manager Alexander Darwall’s commitment to “stick to his guns” investing in “unique growth companies” which are lower leveraged and typically lag the market when more speculative type businesses rally. Analysts were positive overall on the trust, stating that if its underperformance rectified, it could undergo a re-rating.

They added that the current double discount could actually be an “opportune moment for investors”, who could pick up the trust at a “more attractive” rate compared to global trusts trading on a single-digit discount.

The other trust highlighted in this sector was BlackRock Greater Europe, this time moving in the opposite direction.

It is the only one in the sector currently on a premium. At 2.9% this is 6.1 percentage points higher than its long-term average.

It has been one of the sector’s standout performers, making the best returns over one, three, five and 10 years. During the latter it made 395.9% total returns. Kepler analysts said that this “peer group-leading performance” was the main driver of the trust’s premium, a level they said is warranted given the managers proven ability to generate “substantial outperformance” during periods of economic uncertainty.

Although it did not quite meet the criteria the Baillie Gifford European Growth Trust was just outside the list with a 4.3 percentage point narrowing of its long-term discount, which is now at 3.3%.

Since Baillie Gifford assumed management of the trust from Edinburgh Partners in 2019 it has been a strong performer, beating the sector and FTSE Europe ex UK benchmark, returning 76.5% versus 37.5% and 25.2%, respectively. Analysts have been equally bullish on the trust since the takeover, telling Trustnet that they preferred it to the more veteran BlackRock portfolio for European exposure.

Indeed, Winterflood analysts also said earlier in the year, that if the trust’s track record continues to positively develop over time they would not be shocked to see it move to a sustained, premium rating.

Moving onto the IT European Smaller Companies sector, there was only one trust highlighted: Montanaro European Smaller Companies Trust.

The trust is running on a 1.8% premium, a substantial rerating of 9 percentage points from its average 7.2% discount.

It was the best performer in the sector across every time frame, making 621.8% over 10 years while the MSCI ex UK Small Cap benchmark made 298.2%. In fact comparing both sectors it was the strongest performing investment trust focused on Europe. This continuous outperformance may explain why it is the only trust in the small-cap sector currently on a premium.

It holds an FE fundinfo Crown rating of five and invests in quality growth stocks.